Fill Out a Valid Cit 1 New Mexico Template

The CIT-1 New Mexico form is an essential document for corporations operating within the state, encompassing details needed for the calculation of corporate income and franchise tax obligations for the tax year 2020. It requires comprehensive information including the corporation's name, mailing address, Federal Employer Identification Number (FEIN), and New Mexico Business ID, among other identifiers. This form not only caters to standard corporate income reporting but allows for amendments due to various reasons such as audits, capital loss, and more, offering a section for clarifying changes in federal income tax liabilities that haven't yet been reported to New Mexico authorities. Additionally, it delves into specifics about the corporation's accounting method, state of incorporation, the principal business activity, and whether the return is for a unitary group - necessitating detailed data for each corporation within such a group. Filing options for direct refund deposits are also provided, emphasizing the importance of accurate financial detailing for streamlined processing. Furthermore, it integrates schedules for apportioned and allocated income, stressing the significance of precise income distribution for multistate corporations and entities with non-business income. The form rounds off with sections for tax calculation, tax credits, payments, penalties, and interest, making it a comprehensive tool for adhering to New Mexico's corporate tax laws.

Document Preview

2022

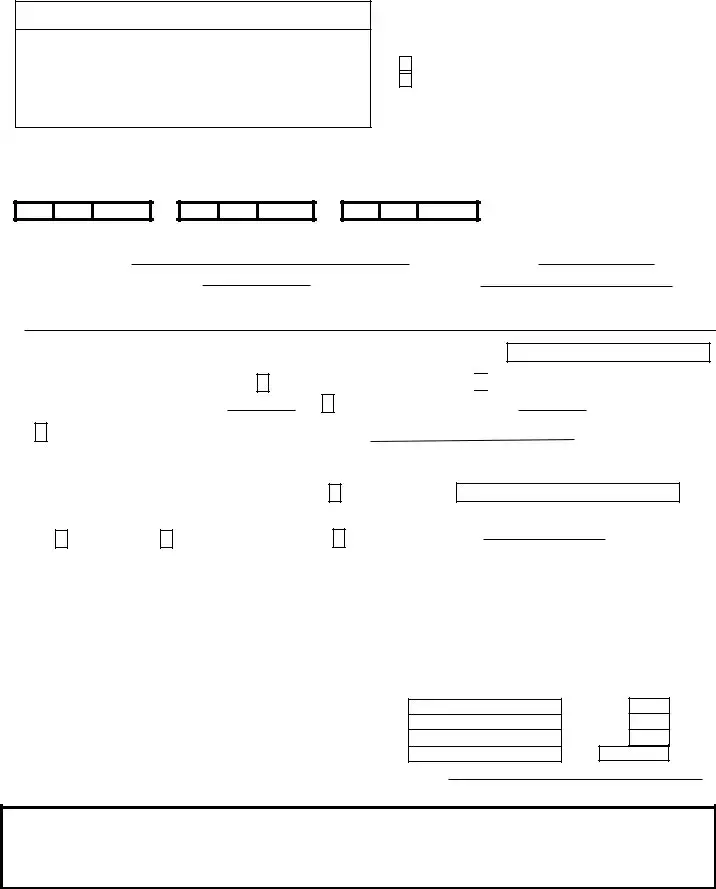

NEW MEXICO CORPORATE INCOME AND FRANCHISE TAX RETURN

Corporation name

1a

Mailing address (number and street name)

2a |

|

|

|

|

|

City |

|

State |

Postal/ZIP code |

3a |

|

|

|

|

|

|

|

|

|

|

If foreign address, enter country |

Foreign province and/or state |

||

3b |

|

|

|

|

|

|

|

|

|

|

FEIN (Required) |

New Mexico Business ID # |

||

5a |

|

5b |

|

|

|

*226080200* |

|||||||

CHECK ONE (Required): |

|

|

|

|

|

|||

4a |

Original Return |

|

|

FOR DEPARTMENT USE ONLY |

||||

|

|

|

|

|

||||

4b |

Amended Return |

|

|

|

|

|

||

|

4b.(i) Type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

4b.(ii) Date: |

|

|

|

|

|

|

|

|

|

|

|

6d |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact phone number |

|||

Fiscal (or |

Extended Due Date |

6a

6b

6c

COMPLETE THE FOLLOWING: |

|

|

A. |

State of incorporation |

A1. Date of incorporation |

B. |

Date business began in New Mexico |

B1. State of commercial domicile |

C. |

Name and address of registered agent in New Mexico |

|

|

|

First Name and Last Name |

|

Address |

|

|

||||

|

|

|

|

|

|

|

|

D. |

NAICS Code (Required) |

|

|

|

|||

E. |

Is this a return for a unitary group? Yes |

|

No |

||||

|

|||||||

|

|

|

|

|

|||

|

|

|

|

|

|||

City |

State |

ZIP code |

D1. Principal business activity in New Mexico

E1. If yes, which type of unitary group?

worldwide combined group

worldwide combined group

consolidated group. Year of election

Member of a unitary group, filing separately. Name of parent entity

NOTE: A unitary group has certain filing requirements. See page 9 of the instructions for definition.

F. Indicate method of accounting: |

|

Cash |

|

Accrual |

|

|

|

|

|

G.If this is the corporation's final return, was the corporation:

Other (specify) F1.

Dissolved

Merged or reorganized

Withdrawn |

G1. Date |

H.Has this corporation's federal income tax liability changed for any year due to an IRS audit or the filing of an amended federal return that has not

been reported to New Mexico? Yes |

|

No |

|

If yes, submit an amended New Mexico Corporate Income and Franchise Tax Return, |

and a copy of the amended federal return or Revenue Agent's Report (RAR), if applicable, to the New Mexico Taxation and Revenue Department.

I. If this a return for a filing group, complete the following information for each corporation in the filing group.

The total of column 3 must equal

|

|

|

Column 3 |

Column 4 |

Column 1 |

|

Column 2 |

Amount of quarterly, tentative, or other |

$50 if corporation |

Corporation name |

|

FEIN |

payments to apply to this return |

pays franchise tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals

J.If other than a corporation, enter your legal entity type (for example, LLC or partnership):

Refund Express!!

RE1 1. Routing number:

RE2 2. Account number:

Have your refund directly deposited. See instructions and fill in 1, 2, 3, and 4.

|

RE3 3. Type: Checking |

|

Savings |

|

|

|

|

Enter X. |

|

Enter X. |

|

|

|

|

|

||

|

|

|

|

|

|

4.REQUIRED: WILL THIS REFUND GO TO OR THROUGH AN ACCOUNT LOCATED OUTSIDE THE UNITED STATES? If yes, you may not use this refund delivery option. See instructions.

RE4 YES |

|

|

|

You must answer |

|

NO |

|

this question. |

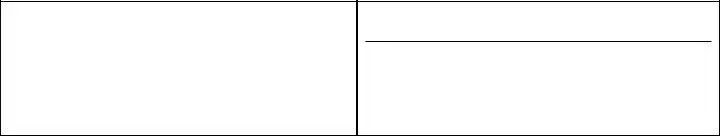

2022

NEW MEXICO CORPORATE INCOME AND FRANCHISE TAX RETURN

|

FEIN |

*226090200* |

|||||

|

|

|

|||||

|

|

|

|||||

1. |

Taxable income before NOL and special deductions (see |

|

|

||||

1. |

|

||||||

|

|

|

|

|

|

|

|

|

1a. Captive REIT deductions. |

|

1a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

1b. Exempt entity deductions. |

|

1b. |

|

|

|

|

2. |

|

|

|

|

|

||

Interest income from municipal bonds, excluding New Mexico bonds. |

2. |

|

|||||

3. |

Other additions to the base income of a unitary group (see |

3. |

|

||||

4. |

Subtotal of base income after additions. Add lines 1, 1a, 1b, 2 and 3. |

4. |

|

||||

5. |

Federal special deductions (from federal Form 1120, line 29b). Enter only a positive number. |

5. |

|

||||

6. |

Interest from U.S. government obligations or |

6. |

|

||||

7. |

Certain foreign dividends, Subpart F income, and GILTI (from |

|

|

||||

7. |

|

||||||

8. |

Other subtractions to the base income of a unitary group (see |

|

|

||||

8. |

|

||||||

9. |

New Mexico net income or loss. Subtract lines 5, 6, 7, and 8 from 4. |

9. |

|

||||

10. |

Net allocated income or loss (from |

|

|

|

10. |

|

|

11. |

Total apportionable income or loss. Subtract line 10 from line 9. |

11. |

|

||||

12. |

New Mexico apportionment percentage (from |

12. |

_ _ _ . _ _ _ _ % |

||||

13. |

Income or loss apportioned to New Mexico. Line 11 multiplied by the percentage on line 12. |

13. |

|

||||

14. |

Net New Mexico allocated income or loss (from |

14. |

|

||||

15. |

New Mexico apportioned net income or loss. Add lines 13 and 14. |

15. |

|

||||

16. |

Net operating loss deduction, not in excess of 80% of line 15. Attach form |

16. |

|

||||

17. |

Liquor license lessor deduction. See |

17. |

|

||||

18. |

Exemption for net income subject to the Entity Level Tax. See |

|

|

||||

18. |

|

||||||

19. |

New Mexico taxable income. Subtract line 16, 17, and 18 from 15. |

|

|

||||

19. |

|

||||||

20. |

New Mexico Income tax. Tax on amount on line 19 (see tax table on page 13 of |

20. |

|

||||

21. |

Total tax credits applied against the income tax liability on line 20 (from |

21. |

|

||||

22. |

Net income tax. Subtract line 21 from line 20. Amount cannot be negative. |

22. |

|

||||

23. |

Franchise tax ($50 per corporation). |

|

|

|

23. |

|

|

24. |

Total income and franchise tax. Add lines 22 and 23 |

24. |

|

||||

25. |

Amended Returns Only. Enter amount of all 2022 refunds received and overpayments applied to 2023. Also |

25. |

|

||||

|

see instructions for line 27 |

|

|

|

|

|

|

|

|

|

|

|

|

||

26. |

Subtotal. Add lines 24 and 25. |

|

|

|

|

|

|

|

|

|

26. |

|

|||

27. |

Total Payments: q Quarterly q Extension |

qApplied from prior year |

27. |

|

|||

|

27a. q Mark this box if you want to use method 4 to calculate penalty and interest on underpayment of |

|

|

||||

|

estimated tax. See instructions, attach |

|

|

||||

28. |

|

|

|

|

|

||

New Mexico income tax withheld from oil and gas proceeds. Attach Forms |

28. |

|

|||||

29. |

New Mexico income tax withheld from a |

29. |

|

||||

30. |

Total payments and tax withheld. Add lines 27 through 29. |

30. |

|

||||

31. |

Tax due. If line 26 is greater than line 30, subtract line 30 from line 26. |

31. |

|

||||

32. |

|

|

|

|

|

|

|

Penalty. See |

|

|

|

32. |

|

||

33. |

Interest. See |

|

|

|

33. |

|

|

34. |

|

|

|

|

|

||

Total amount due. Mail your check separately with |

34. |

|

|||||

35. |

Overpayment. If line 30 is greater than line 26, enter the difference. |

35. |

|

||||

36. |

Amount of overpayment to apply to 2023 liability (not more than line 35). |

36. |

|

||||

37. |

Amount of overpayment to refund. Subtract line 36 from line 35. |

37. |

|

||||

38. |

Total portion of tax credits to refund (from |

|

|

||||

38. |

|

||||||

39. |

Total refund of overpaid tax and refundable credit due to you. Add lines 37 and 38. |

39. |

|

||||

Taxpayer's Signature

I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer or an employee of the taxpayer) is based on all information of which preparer has any knowledge.

Signature of officer |

Date |

|

|

|

|

|

|

|

Title |

Contact phone number |

|

Taxpayer's email address |

|

|

|

Paid Preparer's Use Only

Signature of preparer if |

other than employee of the taxpayer |

Date |

|

P1 |

NMBTIN ____________________________ |

|

|

P2 |

FEIN |

_ |

|

P3 |

Preparer's PTIN |

_____________________ |

|

P4 |

Preparer's phone number ____________________________ |

||

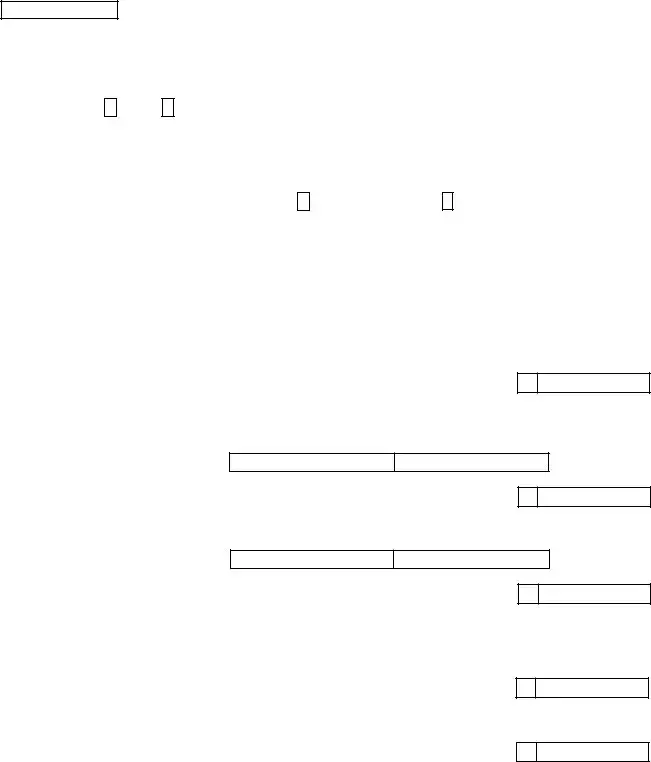

2022

NEW MEXICO APPORTIONED INCOME FOR |

*226280200* |

MULTISTATE CORPORATIONS (attach to |

|

|

FEIN

Taxpayers with income from inside and outside New Mexico must complete this schedule.

The Department cannot accept computerized schedules instead of this form. You must complete column 1, Total Everywhere, and all other applicable line items for the Department to process the return. Round all dollar amounts.

A. Have you changed your reporting of any class or type of allocated or apportioned income from the way it was reported in

a prior taxable year?

Yes

No

B. This entity submitted written notification of its election to use one of the special methods of apportionment of business

income for tax year ending _______________. The effective date of the election is |

______________. See instructions. |

Month/Day/Year |

Month/Day/Year |

C. Mark the box indicating the special method elected.

Manufacturers

Headquarters Operation

PROPERTY FACTOR

Average annual value of inventory |

1a |

Average annual value of real property |

1b |

Average annual value of personal property |

1c |

Rented property. Multiply annual rental value by 8 |

1d |

Total property |

1e |

Column 1 |

Column 2 |

Percent |

Total Everywhere |

Inside New Mexico |

Inside New Mexico |

|

|

Calculate each |

|

|

|

|

|

percentage to four |

|

|

|

|

|

decimal places; for |

|

|

|

|

|

example, 22.5431%. |

|

|

|

1. Property factor. Divide Total property column 2 by column 1 and then multiply by 100...............................................

PAYROLL FACTOR

1

_ _ _ . _ _ _ _%

Wages, salaries, commissions, and other compensation |

2a |

|

of employees related to apportionable income |

|

|

|

|

|

2. Payroll factor. Divide column 2 by column 1 and then multiply by 100 |

+ |

|

SALES FACTOR

2

_ _ _ . _ _ _ _%

gross receipts |

3a |

3. Sales factor. Divide column 2 by column 1 and then multiply by 100 |

+ |

3

_ _ _ . _ _ _ _%

4. |

Sum of factor percentages. Add lines 1, 2, and 3 |

+ |

||

|

4a. Count of factors. Enter the total count of all factors used |

|

|

|

|

4a |

|

|

|

|

NEW MEXICO PERCENTAGE. Divide line 4 by the count of factors used to calculate line 4a |

|

|

|

5. |

||||

4_ _ _ . _ _ _ _%

5_ _ _ . _ _ _ _%

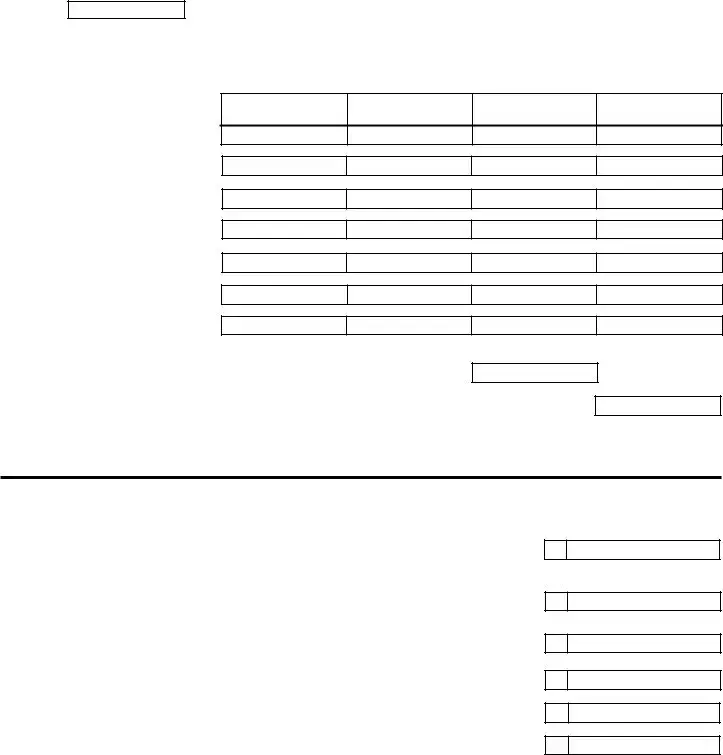

FEIN |

*226380200* |

2022

NEW MEXICO ALLOCATION OF

SCHEDULE OF INCOME NOT DERIVED FROM THE CORPORATION'S TRADE OR BUSINESS The Department cannot accept computerized schedules instead of this form. Round all dollar amounts.

1. |

1 |

|

2. |

2 |

|

3. |

3 |

|

4. |

4 |

|

5. |

Profit or loss on sale or exchange of |

|

|

5 |

|

6. |

6 |

|

7. Other |

7 |

|

|

(Attach schedule) |

|

Column 1

Gross Amount

Column 2

Related Expenses

Column 3

Column 1 less Column 2

Column 4

Allocation to New Mexico

8. |

Net allocated income. |

|

|

Enter here and on |

8 |

9. |

Net New Mexico allocated income. |

|

|

Enter here and on |

9 |

2022

CERTAIN FOREIGN DIVIDENDS, SUBPART F, AND GILTI

1.Certain dividends from foreign corporations (from federal form 1120, Schedule C, Line 14)..............................

2.Subpart F inclusions derived from hybrid dividends of tiered corporations (from federal form 1120, Schedule C,

Line 16b)..............................................................................................................................................................

3.Other inclusions from CFCs under subpart F (from federal form 1120, Schedule C, Line 16c)...........................

4.Global Intangible Low Taxed Income (GILTI) net of the deduction provided under IRC Sec. 250 (federal form 1120, Schedule C, Line 17, net of line 22)............................................................................................................

5.Foreign dividend

6.Total. Add lines 1 through 5. Also enter on line 7,

1

2

3

4

5

6

Document Properties

| Fact | Detail |

|---|---|

| Governing Law | New Mexico Corporate Income and Franchise Tax Act |

| Purpose of Form CIT-1 | To report corporate income and franchise taxes for entities doing business in New Mexico |

| Key Sections | Identifies corporation details, tax year information, business activity, and financial data |

| Amendment Options | Allows for amending returns due to reasons like IRS audit adjustments or capital losses |

| Unitary Group Filing | Includes provisions for unitary groups to file combined or separate returns, specifying election type and member details |

Steps to Filling Out Cit 1 New Mexico

After completing the CIT-1 New Mexico form, it's important to carefully review all entered information for accuracy and completeness. This form is a comprehensive document for reporting corporate income and franchise taxes to the New Mexico Taxation and Revenue Department. Each section should be filled out accurately to ensure compliance with state tax requirements. Here are the steps to follow:

- Enter the corporation name in the designated field.

- For 1a, fill in the mailing address, including number and street name.

- Type in the city, state, and postal/ZIP code in sections 2a, and if applicable, include the foreign address, country, foreign province, and/or state in 3a and 3b.

- Provide the Federal Employer Identification Number (FEIN) in the required field and the New Mexico Business ID # in 5a and 5b.

- Mark the applicable box for the type of return being filed – original or amended – in section 4a through 4d.

- Input the contact phone number in section 6d.

- Fill in the fiscal or short-year tax year start and end dates in 6a and 6b, and if an extension was granted, provide the extended due date in 6c.

- Complete sections A through I with the specific details requested, such as state of incorporation, registered agent information, NAICS code, the corporation's accounting method, and the status of the corporation's final return.

- If applicable, answer the questions regarding federal income tax liability changes due to an IRS audit or filing of an amended return in section H.

- For corporations that are part of a filing group, provide the required information for each corporation in the filing group as instructed in section I.

- If the corporation is not a standard corporation (e.g., LLC, partnership), specify the legal entity type in section J.

- For direct deposit of refunds, complete the information requested in RE1 through RE4, ensuring to answer the question about the account's location.

- Carefully review and transfer financial data to the second page, accurately calculating and entering values as directed from lines 1 through 35.

- Sign and date the form where indicated at the bottom. If a paid preparer was used, ensure the preparer also signs and dates the form and provides their PTIN and contact information.

Upon completion, double-check the form for any errors or omissions. Ensure all necessary attachments and schedules are included before mailing it to the address specified in the form instructions or submitting it through the approved electronic filing system, if available. Compliance with filing deadlines is crucial to avoid penalties and interest.

Frequently Asked Questions

Here are some frequently asked questions about the CIT-1 New Mexico Corporate Income and Franchise Tax Return form:

What is the CIT-1 form used for in New Mexico?

The CIT-1 form is utilized by corporations to file their corporate income and franchise taxes in New Mexico. It gathers information about taxable income, deductions, and credits to calculate the taxes owed to the state or the refunds due to the corporation.

Who needs to file the CIT-1 New Mexico form?

Any corporation that is incorporated, doing business, or deriving income from within the state of New Mexico is required to file the CIT-1 form. This includes domestic and foreign corporations.

What are the different amendments options (4b to 4d) listed on the form?

The CIT-1 form allows for amendments in several specific areas:

- Amended–RAR: To adjust the return following an audit or adjustment by the IRS.

- Amended–Capital Loss: For corrections related to capital loss calculations.

- Amended–Other: For any other adjustments not covered by the first two categories.

How does a corporation indicate if it's part of a unitary business?

On the CIT-1 form, corporations must indicate whether they are filing as a part of a unitary business by answering "Yes" and specifying the type of unitary group they belong to (e.g., worldwide group, water's-edge group, or consolidated group) including the election year.

What should a corporation do if its federal income tax liability changes?

If there's a change in the corporation's federal income tax liability due to an IRS audit or amended federal return, the corporation must file an amended CIT-1 form. Along with this, they should submit a copy of the amended federal return or the IRS's Revenue Agent's Report if applicable.

Can the CIT-1 form accommodate multiple corporations in a filing group?

Yes. The form provides space to include information for up to three members of a filing group. If there are more than three corporations in the group, additional forms (CIT-S) should be completed to accommodate them.

What is the due date for filing the CIT-1 form?

The due date for filing the CIT-1 form typically aligns with the corporation's fiscal year-end. An extended due date can be noted in the form for those who have applied for an extension.

How is the New Mexico apportionment percentage calculated?

Corporations operating both within and outside New Mexico must calculate their New Mexico apportionment percentage using the CIT-A form. This percentage is based on the proportion of the corporation's property, payroll, and sales situated in New Mexico relative to those total figures everywhere.

What should a corporation do if it overpays and is due a refund?

If a corporation overpays its taxes, it can opt for the overpayment to be refunded or applied to its liability for the next tax year. For direct refund, the corporation must provide its banking information for direct deposit unless the refund will go to an account outside the United States, in which case other refund delivery options should be explored.

Common mistakes

Filling out the CIT-1 New Mexico Corporate Income and Franchise Tax Return accurately is crucial for any business to remain compliant with state tax laws. However, there are several common mistakes that businesses tend to make while completing this form. Understanding these errors can help ensure that your tax return is filled out accurately, preventing potential issues or delays with the New Mexico Taxation and Revenue Department.

Not providing the correct FEIN or New Mexico Business ID#: These numbers are essential for identifying your business. Errors or omissions can lead to the misprocessing of your tax return.

Incorrectly filling out the financial sections, particularly lines 1a through 9, which cover taxable income, deductions, and net income. It’s crucial to carefully calculate these figures to ensure accurate tax liability assessment.

Failing to accurately report the NAICS Code on section D. This code is required and helps in categorizing the business for statistical purposes. Incorrect codes can lead to improper data classification.

Omitting information about the unitary group status if applicable (section E). If your business is part of a unitary group, specific filing requirements apply, and neglecting to provide details about the group type or parent entity can result in an incorrect return.

Choosing the wrong method of accounting on section F. Your choice between cash and accrual (or other) impacts how income and expenses are reported. Misalignment with your bookkeeping practices can lead to discrepancies.

Not indicating whether the corporation’s federal income tax liability has changed due to an IRS audit or an amended federal return (section H). This is critical information that can affect your state tax liability.

Errors in entering bank account information for refunds under the Refund Express section (RE1 through RE4). Incorrect routing or account numbers can delay or misdirect your refund.

Avoiding these errors requires attention to detail and a clear understanding of your business's financial and operational specifics as they relate to the New Mexico CIT-1 form. Double-checking entries, consulting with a tax professional if you're unsure, and ensuring that you have the most current form and instructions from the New Mexico Taxation and Revenue Department are good practices to follow.

Documents used along the form

When businesses in New Mexico prepare their CIT-1 New Mexico Corporate Income and Franchise Tax Return, it's essential to know what other forms and documents might be necessary. This ensures that all financial aspects of the corporation are accurately reported and compliant with state tax laws. Below is a list of forms and documents often used alongside the CIT-1 form, designed to provide a comprehensive approach to corporate tax filing.

- Form RPD-41379: This form is used for reporting Net Operating Loss (NOL) deductions. Corporations that have incurred losses can use this form to carry over these losses to offset future profits, thereby reducing future taxable income.

- Form CIT-A: Necessary for multistate corporations, this schedule helps determine the portion of income apportioned to New Mexico. It's crucial for businesses operating both inside and outside the state, ensuring taxes are calculated based on the income generated within New Mexico.

- Form CIT-B: This form is for the allocation of non-business income or loss. It distinguishes between earnings from the corporation's everyday business activities and other sources of income or loss, ensuring accurate tax reporting.

- Form CIT-C: Used for detailing certain foreign dividends, Subpart F income, and Global Intangible Low-Taxed Income (GILTI). This form helps corporations report income from foreign operations, which may be subject to taxation or entitled to special deductions and credits.

- Form CIT-CR: This form is critical for claiming tax credits against the corporation's income tax liability. It enables corporations to lower their tax bill by claiming eligible tax credits for various qualifying activities and investments.

- Form RPD-41287: Utilized for calculating penalties and interest on underpayments of estimated tax. This form is essential for corporations that have not paid enough tax through withholding or estimated tax payments, helping them compute penalties and interest due.

Preparing a comprehensive and compliant corporate tax return involves more than just completing the CIT-1 form. Utilizing the appropriate forms and documents listed above can help ensure that all relevant information is reported. This not only aids in complying with New Mexico tax laws but also in taking advantage of any deductions, credits, and special tax treatments available. As such, it's crucial for corporations to be aware of and understand these additional forms and documents to manage their tax obligations effectively.

Similar forms

The CIT-1 New Mexico form, focused on corporate income and franchise tax returns, shares similarities with several other tax documents used across the United States. These documents often serve to collect similar types of financial information from entities but are tailored to the specific requirements of different jurisdictions or tax purposes.

One such document is the Federal Form 1120, known as the U.S. Corporation Income Tax Return. Like the CIT-1 New Mexico form, Form 1120 is used by corporations to report their income, gains, losses, deductions, credits, and to figure out their federal income tax liability. Both forms require detailed financial information, including taxable income before adjustments, deductions related to dividends or other specific exemptions, and net operating loss deductions. Additionally, each form has sections designated for reporting adjustments due to amendments or audits, further emphasizing their focus on accurate and current financial representation.

Another document bearing resemblance to the CIT-1 New Mexico form is the State of California Form 100, the California Corporation Franchise or Income Tax Return. This form, much like the New Mexico CIT-1, collects information on income, deductions, and tax credits specific to corporations operating within the state. Both forms are tailored to suit the tax regulations of their respective states, requiring information on income apportionment and specific state-related deductions. Additionally, they both accommodate details regarding unitary or combined reporting for corporations that are part of larger groups, reflecting the states' approaches to taxing business entities.

The Form IT-203, used by corporations filing in New York State, also aligns closely with the CIT-1 form's structure and purpose. It’s designed for entities to report income and calculate both franchise and income tax obligations within the state. Similar sections that appear on both forms include those for reporting federal income adjustments, calculating state-specific income modifications, and identifying apportionment percentages. Both New Mexico and New York require detailed disclosures about business activities, ownership details, and financial adjustments, evidencing the emphasis on comprehensive state-level taxation compliance.

Dos and Don'ts

When completing the CIT-1 New Mexico form, it's crucial to follow certain guidelines to ensure the process goes smoothly and correctly. Here are some essential do's and don'ts:

- Do ensure you have all the necessary information before starting. This includes your corporation's FEIN, New Mexico Business ID, and financial records for the fiscal year.

- Do read through the entire form and instructions provided by the New Mexico Taxation and Revenue Department to understand all requirements.

- Do use black ink and print clearly if filling out the form by hand. This makes it easier for processing and reduces the risk of errors.

- Do double-check all the financial figures you enter. Any mistakes could lead to discrepancies and potential audits.

- Do sign and date your return. An unsigned return is considered invalid and will not be processed.

- Don't use the form to report income not related to corporate or franchise tax. The CIT-1 is specifically designed for these purposes.

- Don't guess on figures or information. If unsure, consult the appropriate documentation or seek professional advice to ensure accuracy.

- Don't leave required fields blank. If a particular section does not apply, mark it with "N/A" or "0" if it's numerical.

- Don't forget to attach all required additional schedules and documents. Failing to do so can delay processing or result in an incomplete return.

By following these guidelines, you'll help ensure that your CIT-1 New Mexico form is accurately completed and submitted. This not only complies with tax laws but also helps in the smooth operation of your corporation within the state.

Misconceptions

Understanding the intricacies of tax forms can be confusing, and the New Mexico CIT-1 form is no exception. Businesses often harbor misconceptions about this form that can lead to errors in filing corporate income and franchise tax returns. Here are six common misconceptions clarified to assist in the accurate completion of the CIT-1 form.

- Misconception #1: The belief that only New Mexico-based corporations need to file the CIT-1 form. In reality, any corporation that conducts business in New Mexico, regardless of where it is physically based, is required to file this form.

- Misconception #2: Thinking that the CIT-1 form is only for the calculation and payment of corporate income tax. This form is actually used to report both corporate income tax and franchise tax, which is applicable to any corporation registered with the New Mexico Secretary of State.

- Misconception #3: Some corporations assume that if they don't owe any tax, they don't need to file the CIT-1 form. However, filing is mandatory for all corporations operating in New Mexico, even if no tax is due, to maintain compliance with state tax regulations.

- Misconception #4: There's a common belief that amendments to the CIT-1 form can only be made for errors in tax calculation. Amendments can actually be made for several reasons, including changes in federal taxable income, IRS audits, or to correct previously reported information.

- Misconception #5: Many believe that the CIT-1 form does not cover subsidiaries or unitary groups. Contrarily, unitary groups must file a consolidated CIT-1 form, and specific sections of the form address the reporting requirements for members of a unitary group.

- Misconception #6: A misconception exists that refunds from overpayment are automatically processed. Taxpayers must provide specific banking information for direct deposit, and there are conditions under which refunds cannot be directly deposited, such as accounts outside the United States.

Clearing up these misconceptions ensures corporations can file their New Mexico CIT-1 forms correctly and on time. Accurate filing is crucial for compliance with state tax laws and for avoiding potential penalties. If uncertainties remain, it's advisable to seek guidance from the New Mexico Taxation and Revenue Department or a tax professional.

Key takeaways

Filling out the CIT-1 New Mexico Corporate Income and Franchise Tax Return accurately and completely is crucial for corporations operating within New Mexico. Here are four key takeaways for navigating this process:

- Understanding your entity type and tax requirements is fundamental. The form caters to various types of corporations, including unitary groups and those involved in specialized industries. Identifying the correct entity type and understanding the specific requirements for your business, such as the need for submitting additional schedules for multi-state corporations, is the first step in ensuring compliance and optimizing your tax liabilities.

- Accurate financial reporting on the CIT-1 form is vital. This form requires detailed financial information, including taxable income, deductions, and tax credits. Accuracy in reporting your corporation’s income, deductions, and applicable credits is essential to avoid potential penalties, interest on underpayments, or audits. It's important to reconcile the figures reported on this form with those on the federal return and other financial statements.

- Applying the correct tax rates and understanding tax credits can substantially affect the amount owed to the state. The CIT-1 form outlines how to calculate both income and franchise taxes, including applying specific tax rates and claiming allowable tax credits. Familiarize yourself with the tax rates, how to apply them based on your taxable income, and the tax credits your corporation may be eligible for to reduce your tax liability.

- Amendments and IRS audits: If your corporation's federal income tax liability changes due to an IRS audit or if you need to correct a previously filed return, amending your CIT-1 New Mexico return is necessary. This ensures that your tax responsibilities are up-to-date and reflects any changes or corrections to your financial situation. Keeping abreast of amendments and having clear records will facilitate a smooth process in updating your tax filings.

Adhering to these guidelines when completing the CIT-1 New Mexico form will help ensure that your corporation remains compliant with New Mexico’s tax laws, potentially minimizing your tax liabilities through accurate reporting and utilization of applicable deductions and credits.

Common PDF Templates

New Mexico Llc Registration - Approval from the Town Clerk or a designated official is required to finalize the business registration process.

New Mexico Filing Requirements for Non Residents - Noting whether the employee missed any workdays due to the injury or illness underlines the severity of the incident.