Fill Out a Valid New Mexico Withholding Template

Navigating tax obligations is essential for both employers and employees, and understanding the specifics can significantly ease this process. The New Mexico Withholding Tax form, FYI-104, serves as a key tool in this regard, offering comprehensive guidance on the state's withholding tax system, effective January 1, 2022. Importantly, this document outlines that adjustments for New Mexico withholding will no longer be made based on the number of allowances indicated on pre-2020 Federal Form W-4, signaling a shift in the way withholdings are calculated. It emphasizes the need for employees to use the New Mexico state withholding tables if they continue to utilize an older version of the Federal W-4 for state tax purposes. In addition to detailing these critical changes, the FYI-104 form provides valuable information on who is required to withhold taxes, how the withholding amount is determined, and the correct usage of withholding tax tables. Additionally, it addresses how to report and pay these taxes, management of additional withholding amounts, specifics on withholding for gambling winnings, and guidance for handling tax statements and reconciliation. This comprehensive form is vital for employers in ensuring compliance with state taxation regulations, offering a pathway through the often complex landscape of tax withholding in New Mexico.

Document Preview

FOR YOUR INFORMATION

New Mexico

Taxation and Revenue Department

Tax Information/Policy Office P.O. Box 630 Santa Fe, New Mexico |

NEW MEXICO

WITHHOLDING TAX

Effective January 1, 2023

Please note: There are no longer adjustments made to New Mexico withholding due to the number of allowances taken on

This publication contains general information on the New Mexico withholding tax and tax tables for the percentage method of withholding. Taxpayers should be aware that subsequent legislation, regulations, court decisions, revenue rulings, notices and announcements may affect the accuracy of its contents. For more information, please contact the nearest tax district field office or check the department’s web site at www.tax.newmexico.gov.

CONTENTS |

|

General Information For New Mexico Withholding Tax |

2 |

Changes to forms beginning 2020 |

2 |

Who Must Withhold |

2 |

Amount To Withhold |

2 |

How To Use The Withholding Tax Tables |

2 |

How To Report And Pay Withholding Taxes |

3 |

Additional Withholding Amounts |

3 |

Withholding On Gambling Winnings |

3 |

Annual Withholding Statements |

3 |

Annual Reconciliation |

4 |

Withholding From Irregular Or Supplemental Wages Or Fringe Benefits |

4 |

Special Situations |

4 |

For Further Information |

4 |

New Mexico State Wage Withholding Tax Tables |

5 |

New Mexico Taxation and Revenue Department

General Information For

New Mexico Withholding Tax

New Mexico withholding tax is similar to federal withholding tax. It is calculated based on an estimate of an employee or individual’s New Mexico income tax liability and is then credited against the employee or individual’s actual income tax liability on that person’s New Mexico personal income tax return.

Changes to forms beginning 2020

The Federal government issued a revised Federal Form

New Mexico does not have a state equivalent of the Federal Form

Employees who have income that is exempt from New Mexico tax (for example, Native Americans working and living on their tribal land; military members with income from

Due to changes in federal law effective from 2018, state income tax liability is not reduced based on the number of personal exemptions claimed by a taxpayer. Although the Standard Deduction amount was increased for all taxpayers, the tax liability will likely increase for households with 2 or more dependents. The withholding tables in this publication have been updated to reflect these changes and the change to the federal

Employees may opt to have additional amounts of money taken out from their paychecks for New Mexico withholding purposes. This can be requested by employees on their New Mexico withholding

The Department’s guidance on withholding relies on the Internal Revenue Service information for accuracy. This publication is subject to revision as further guidance from the Internal Revenue Service is released.

Who Must Withhold

Every employer, including employers of some agricultural workers, who withholds a portion of an employee’s wages for payment of federal income tax must withhold New Mexico income tax. There is a limited exception for certain nonresident employees (See Note 2 below.) Others required to withhold New Mexico income tax include gambling establishments on paid winnings and payers of pension and annuity income when requested to do so. More information is provided on this below.

“Employer” means a person or an employee of that person, doing business in New Mexico or deriving income from New Mexico sources who pays wages to an employee for services performed. An employer is the person having control of the payment of wages.

“Employee” means a New Mexico resident who performs services either within or without the state for an employer, or a nonresident of New Mexico who performs services within the state for an employer.

“Wages” means remuneration in cash or other form for services performed by an employee for an employer.

Notes:

1)Pension and annuity income of a New Mexico resident is subject to income tax in New Mexico, but New Mexico does not require payers to withhold state income tax on pensions and annuities unless the payee requests the payer of their retirement benefits to withhold state tax. To report withholding tax, a payer must be registered with the state using

2)Employers are not required to withhold New Mexico income tax from wages of nonresident employees working in New Mexico for 15 or fewer days during the calendar year.

3)Persons who are

Amount to Withhold

Refer to the New Mexico State Wage Withholding Tax Tables for Percentage Method of Withholding on page 5 of this publication for the amount to withhold. No withholding is required if the total withholding for an employee during any one month is less than one dollar. For New Mexico residents the employer is required to withhold New Mexico income tax from all wages of the employee regardless of the employee’s work location. For nonresident employees, the employer is required to withhold New Mexico income tax only from wages the employee earns within the state. Refer to definitions of “employer,” “employee” and “wages” to determine if withholding tax is required.

How to use the Withholding Tax Tables

Determine the amount to withhold from the appropriate tax tables starting on page 5 based on the payroll period and the employee’s filing status.

New Mexico Taxation and Revenue Department

Example: A married employee has taxable wages of $1,000.00 weekly. This employee has also asked that an additional $20.00 be taken out of their check each pay period.

1.Determine the withholding based on the taxable wage payment of $1,000.00

2.Use Table 1 for weekly pay period. Use section

(b) for a married person. If the amount of wages is over $728 but not over $1,036, the amount of state tax withheld shall be $14.77 + 4.9% of excess over $728.

3.

4.$14.77 + $13.33 = $28.10 withholding tax due

5.$28.10 + $20.00 (Additional withholding requested by employee) = $48.10.

How to Report and Pay Withholding Taxes

New Mexico withholding tax prior to July 1, 2021 was reported along with gross receipts and compensating tax on the Form

Please note:

Reporting withholding information to the Department of Workforce Solutions and the Workers Compensation Administration does not fulfill your obligation to report and pay withholding tax to the Taxation and Revenue Department. Taxpayers must still file and pay using one of the methods described in the above paragraph.

If you change your business name or address or need to cancel your New Mexico Business Tax Identification Number (NMBTIN) previously known as CRS I.D. number, use Form

Starting on July 1, 2021, the name of the CRS I.D. number changed to New Mexico Business Tax Identification Number (NMBTIN). The name change of the identification number will happen automatically. If you will need to cancel the use of the NMBTIN or change your business address, you will use Form

Child support withholding is NOT reported to the Taxation and Revenue Department. For information about child support withholding you will need to contact the Human Services Department at

If you use the cumulative method of withholding for federal withholding, you may use this same method for your state withholding.

Additional Withholding Amounts

Many employees request additional amounts be withheld for federal purposes (see Form

Withholding on Gambling Winnings

Operators, including nonprofit entities, of gambling establishments (racetracks, casinos, state lottery, bingo) must withhold 6% from winnings and file income and withholding information returns for state purposes if they are required to withhold or report for federal purposes. Operators must report and pay the amount of state tax withheld from gambling winnings prior to July 1, 2021, on the Form

Annual Withholding Statements

Every person who has withheld state tax during the year from wages, pensions and annuities, or gambling winnings is required to file an annual statement of withholding on or before the last day of January for each employee, pension or annuity recipient, or gambling winner. New Mexico accepts the state copy of any Federal income and withholding statement, including Federal Form

Taxpayers who need to submit income and withholding statements to the Department may learn more by reviewing Publication

Note: Starting June 18, 2021, the law requires that employers provide information regarding state assistance for

New Mexico Taxation and Revenue Department

credit. The information shall be provided in English and Spanish. This information is located in

Note: Starting tax year 2019, the Department began requiring electronic submittal of income and withholding information returns for employers who have 25 or more employees. The withholding statements are due at the end of January. Electronic submissions can be submitted through the Combined Federal/State Filing Program or by using TAP at https://tap.state.nm.us

Annual Reconciliation

New Mexico withholding taxpayers may file Form RPD- 41072, Annual Summary of Withholding Tax. The report is available for taxpayer’s use but is not required to be filed. This report allows for the taxpayer to reconcile the total amounts shown as withheld on annual withholding statements furnished to withholdees (Federal Forms

Withholding from Irregular or

Supplemental Wages or Fringe Benefits

The same method used for calculating federal withholding on irregular or supplemental wages should be used for state withholding. If the taxpayer uses the cumulative method of withholding for federal withholding, this same method may be used for state withholding. If withholding from fringe benefits for federal purposes, the taxpayer must also withhold from fringe benefits for state purposes using the same method used for calculating federal withholding. If the federal withholding is calculated using a flat percent, a flat 5.9 percent of the supplemental wage or fringe benefit amount should be withheld for state tax purposes.

NOTE: In the case of a married employee who has elected withholding at the higher single rate for federal purposes, the single rate for New Mexico state withholding purposes must also be used.

Special Situations

Generally, if an employee’s withholding is correct for federal purposes, it will be correct for state income tax purposes, but there are certain situations in which an

employee may be correctly withholding for federal purposes but under withhold for state purposes:

1)If the employee has supplemental, overtime pay, bonuses that are paid separately from their normal wages, the Department recommends using Table 8 on page 8.

2)If the employee increased

3)If the employee requested that additional amounts be withheld for federal purposes.

There are also situations where individuals may have income that is subject to federal taxation but exempt from taxation by New Mexico. In these situations, New Mexico withholding on the exempt income would not be necessary.

Examples of income exempt from New Mexico tax are:

1)Income of a Native American who is a member of a New Mexico federally recognized Indian nation, tribe or pueblo that was wholly earned on the lands of the Indian nation or pueblo of which the individual is an enrolled member while domiciled on that land, Indian nation or pueblo.

2)Income from

Employment may require some New Mexico residents to spend extensive time in another state with an income tax that is comparable to the New Mexico income tax. Residents of New Mexico are generally subject to New Mexico income tax on all their income, but if that income is also taxed by another state, New Mexico allows a credit for the other state’s income tax on that income on their personal income tax return. New Mexico withholding tax can be reduced or eliminated on such wages. To reduce or eliminate withholding on such wages, taxpayers should indicate this on their Form

For Further Information

If employees express concern about their withholding, employers may recommend that they obtain the following publications:

Internal Revenue Service Form

Internal Revenue Service Publication 919 Is My Withholding Correct? (Call

New Mexico Taxation and Revenue Department

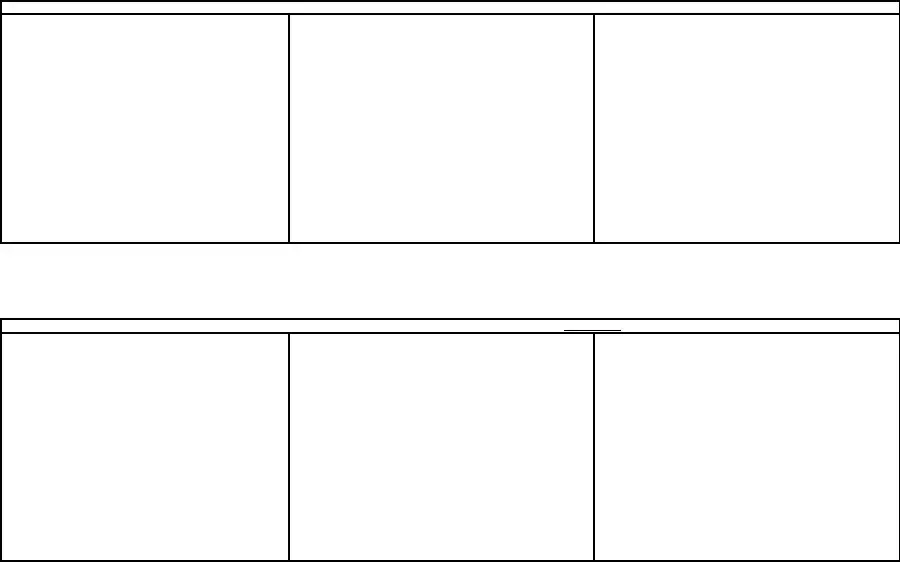

New Mexico State Wage Withholding Tax Tables for Percentage Method of Withholding

(For wages paid on or after January 1, 2023)

|

|

|

|

|

|

|

|

|

|

Table 1 - If the Payroll Period with Respect to an Employee is WEEKLY |

|

|

|

|

|

|

|

|

|

||||||||||

(a) SINGLE person |

|

|

|

|

|

|

(b) MARRIED person |

|

|

|

|

|

|

(c) HEAD of HOUSEHOLD person |

|

|

|

|

|||||||||||

If the amount |

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

||||||||||

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

|||||||||

Not Over |

$ |

133 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

266 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

200 |

|

$0.00 |

|

|

|

|

|||

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

|

But not over: |

|

|

|

of excess over - |

Over: |

|

But not over: |

|

|

|

of excess over - |

||||||||||

$ |

133 |

$ |

239 |

|

|

|

1.7% |

$ |

133 |

$ |

266 |

$ |

420 |

$ |

- |

|

1.7% |

$ |

266 |

$ |

200 |

$ |

354 |

|

|

|

1.7% |

$ |

200 |

$ |

239 |

$ |

345 |

$ |

1.80 |

+ |

3.2% |

$ |

239 |

$ |

420 |

$ |

574 |

$ |

2.62 |

+ |

3.2% |

$ |

420 |

$ |

354 |

$ |

508 |

$ |

2.62 |

+ |

3.2% |

$ |

354 |

$ |

345 |

$ |

441 |

$ |

5.18 |

+ |

4.7% |

$ |

345 |

$ |

574 |

$ |

728 |

$ |

7.54 |

+ |

4.7% |

$ |

574 |

$ |

508 |

$ |

662 |

$ |

7.54 |

+ |

4.7% |

$ |

508 |

$ |

441 |

$ |

633 |

$ |

9.70 |

+ |

4.9% |

$ |

441 |

$ |

728 |

$ |

1,036 |

$ |

14.77 |

+ |

4.9% |

$ |

728 |

$ |

662 |

$ |

969 |

$ |

14.77 |

+ |

4.9% |

$ |

662 |

$ |

633 |

$ |

941 |

$ |

19.13 |

+ |

4.9% |

$ |

633 |

$ |

1,036 |

$ |

1,497 |

$ |

29.85 |

+ |

4.9% |

$ |

1,036 |

$ |

969 |

$ |

1,431 |

$ |

29.85 |

+ |

4.9% |

$ |

969 |

$ |

941 |

$ |

1,383 |

$ |

34.20 |

+ |

4.9% |

$ |

941 |

$ |

1,497 |

$ |

2,189 |

$ |

52.46 |

+ |

4.9% |

$ |

1,497 |

$ |

1,431 |

$ |

2,123 |

$ |

52.46 |

+ |

4.9% |

$ |

1,431 |

$ |

1,383 |

$ |

2,537 |

$ |

55.88 |

+ |

4.9% |

$ |

1,383 |

$ |

2,189 |

$ |

4,113 |

$ |

86.38 |

+ |

4.9% |

$ |

2,189 |

$ |

2,123 |

$ |

4,046 |

$ |

86.38 |

+ |

4.9% |

$ |

2,123 |

$ |

2,537 |

$ |

4,172 |

$ |

112.41 |

+ |

4.9% |

$ |

2,537 |

$ |

4,113 |

$ |

6,324 |

$ |

180.62 |

+ |

4.9% |

$ |

4,113 |

$ |

4,046 |

$ |

6,258 |

$ |

180.62 |

+ |

4.9% |

$ |

4,046 |

$ |

4,172 |

|

and over |

$ |

192.51 |

+ |

5.9% |

$ |

4,172 |

$ |

6,324 |

|

and over |

$ |

288.98 |

+ |

5.9% |

$ |

6,324 |

$ |

6,258 |

|

and over |

$ |

288.98 |

+ |

5.9% |

$ |

6,258 |

|

|

|

|

|

|

|

|

|

Table 2 - If the Payroll Period with Respect to an Employee is |

|

|

|

|

|

|

|

|

||||||||||||

(a) SINGLE person |

|

|

|

|

|

|

(b) MARRIED person |

|

|

|

|

|

|

(c) HEAD of HOUSEHOLD person |

|

|

|

|

|||||||||||

If the amount |

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

||||||||||

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

|||||||||

Not Over |

$ |

266 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

533 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

400 |

|

$0.00 |

|

|

|

|

|||

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

||||||||||||

$ |

266 |

$ |

478 |

|

|

|

1.7% |

$ |

266 |

$ |

533 |

$ |

840 |

|

|

|

1.7% |

$ |

533 |

$ |

400 |

$ |

708 |

|

|

|

1.7% |

$ |

400 |

$ |

478 |

$ |

689 |

$ |

3.60 |

+ |

3.2% |

$ |

478 |

$ |

840 |

$ |

1,148 |

$ |

5.23 |

+ |

3.2% |

$ |

840 |

$ |

708 |

$ |

1,015 |

$ |

5.23 |

+ |

3.2% |

$ |

708 |

$ |

689 |

$ |

882 |

$ |

10.37 |

+ |

4.7% |

$ |

689 |

$ |

1,148 |

$ |

1,456 |

$ |

15.08 |

+ |

4.7% |

$ |

1,148 |

$ |

1,015 |

$ |

1,323 |

$ |

15.08 |

+ |

4.7% |

$ |

1,015 |

$ |

882 |

$ |

1,266 |

$ |

19.40 |

+ |

4.9% |

$ |

882 |

$ |

1,456 |

$ |

2,071 |

$ |

29.54 |

+ |

4.9% |

$ |

1,456 |

$ |

1,323 |

$ |

1,938 |

$ |

29.54 |

+ |

4.9% |

$ |

1,323 |

$ |

1,266 |

$ |

1,882 |

$ |

38.25 |

+ |

4.9% |

$ |

1,266 |

$ |

2,071 |

$ |

2,994 |

$ |

59.69 |

+ |

4.9% |

$ |

2,071 |

$ |

1,938 |

$ |

2,862 |

$ |

59.69 |

+ |

4.9% |

$ |

1,938 |

$ |

1,882 |

$ |

2,766 |

$ |

68.40 |

+ |

4.9% |

$ |

1,882 |

$ |

2,994 |

$ |

4,379 |

$ |

104.92 |

+ |

4.9% |

$ |

2,994 |

$ |

2,862 |

$ |

4,246 |

$ |

104.92 |

+ |

4.9% |

$ |

2,862 |

$ |

2,766 |

$ |

5,074 |

$ |

111.75 |

+ |

4.9% |

$ |

2,766 |

$ |

4,379 |

$ |

8,225 |

$ |

172.77 |

+ |

4.9% |

$ |

4,379 |

$ |

4,246 |

$ |

8,092 |

$ |

172.77 |

+ |

4.9% |

$ |

4,246 |

$ |

5,074 |

$ |

8,343 |

$ |

224.83 |

+ |

4.9% |

$ |

5,074 |

$ |

8,225 |

$ |

12,648 |

$ |

361.23 |

+ |

4.9% |

$ |

8,225 |

$ |

8,092 |

$ |

12,515 |

$ |

361.23 |

+ |

4.9% |

$ |

8,092 |

$ |

8,343 |

|

and over |

$ |

385.02 |

+ |

5.9% |

$ |

8,343 |

$ |

12,648 |

|

and over |

$ |

577.96 |

+ |

5.9% |

$ |

12,648 |

$ |

12,515 |

|

and over |

$ |

577.96 |

+ |

5.9% |

$ |

12,515 |

New Mexico Taxation and Revenue Department

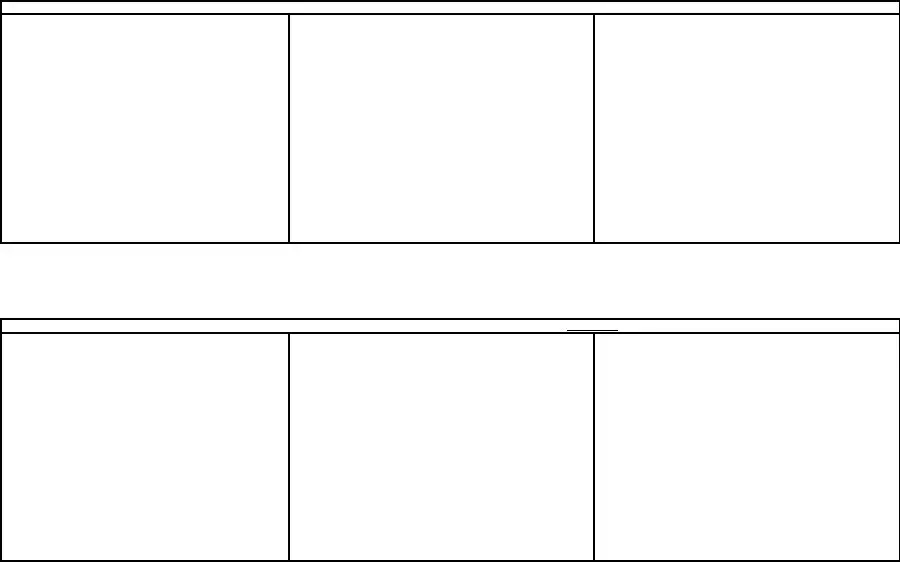

New Mexico State Wage Withholding Tax Tables for Percentage Method of Withholding

(For wages paid on or after January 1, 2023)

|

|

|

|

|

|

|

|

|

Table 3 - If the Payroll Period with Respect to an Employee is |

|

|

|

|

|

|

|

|

||||||||||||

(a) SINGLE person |

|

|

|

|

|

|

(b) MARRIED person |

|

|

|

|

|

|

(c) HEAD of HOUSEHOLD person |

|

|

|

|

|||||||||||

If the amount |

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

||||||||||

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

|||||||||

Not Over |

$ |

289 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

577 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

433 |

|

$0.00 |

|

|

|

|

|||

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

||||||||||||

$ |

289 |

$ |

518 |

|

|

|

1.7% |

$ |

289 |

$ |

577 |

$ |

910 |

|

|

|

1.7% |

$ |

577 |

$ |

433 |

$ |

767 |

|

|

|

1.7% |

$ |

433 |

$ |

518 |

$ |

747 |

$ |

3.90 |

+ |

3.2% |

$ |

518 |

$ |

910 |

$ |

1,244 |

$ |

5.67 |

+ |

3.2% |

$ |

910 |

$ |

767 |

$ |

1,100 |

$ |

5.67 |

+ |

3.2% |

$ |

767 |

$ |

747 |

$ |

955 |

$ |

11.23 |

+ |

4.7% |

$ |

747 |

$ |

1,244 |

$ |

1,577 |

$ |

16.33 |

+ |

4.7% |

$ |

1,244 |

$ |

1,100 |

$ |

1,433 |

$ |

16.33 |

+ |

4.7% |

$ |

1,100 |

$ |

955 |

$ |

1,372 |

$ |

21.02 |

+ |

4.9% |

$ |

955 |

$ |

1,577 |

$ |

2,244 |

$ |

32.00 |

+ |

4.9% |

$ |

1,577 |

$ |

1,433 |

$ |

2,100 |

$ |

32.00 |

+ |

4.9% |

$ |

1,433 |

$ |

1,372 |

$ |

2,039 |

$ |

41.44 |

+ |

4.9% |

$ |

1,372 |

$ |

2,244 |

$ |

3,244 |

$ |

64.67 |

+ |

4.9% |

$ |

2,244 |

$ |

2,100 |

$ |

3,100 |

$ |

64.67 |

+ |

4.9% |

$ |

2,100 |

$ |

2,039 |

$ |

2,997 |

$ |

74.10 |

+ |

4.9% |

$ |

2,039 |

$ |

3,244 |

$ |

4,744 |

$ |

113.67 |

+ |

4.9% |

$ |

3,244 |

$ |

3,100 |

$ |

4,600 |

$ |

113.67 |

+ |

4.9% |

$ |

3,100 |

$ |

2,997 |

$ |

5,497 |

$ |

121.06 |

+ |

4.9% |

$ |

2,997 |

$ |

4,744 |

$ |

8,910 |

$ |

187.17 |

+ |

4.9% |

$ |

4,744 |

$ |

4,600 |

$ |

8,767 |

$ |

187.17 |

+ |

4.9% |

$ |

4,600 |

$ |

5,497 |

$ |

9,039 |

$ |

243.56 |

+ |

4.9% |

$ |

5,497 |

$ |

8,910 |

$ |

13,702 |

$ |

391.33 |

+ |

4.9% |

$ |

8,910 |

$ |

8,767 |

$ |

13,558 |

$ |

391.33 |

+ |

4.9% |

$ |

8,767 |

$ |

9,039 |

|

and over |

$ |

417.10 |

+ |

5.9% |

$ |

9,039 |

$ |

13,702 |

|

and over |

$ |

626.13 |

+ |

5.9% |

$ |

13,702 |

$ |

13,558 |

|

and over |

$ |

626.13 |

+ |

5.9% |

$ |

13,558 |

|

|

|

|

|

|

|

|

|

|

Table 4 - If the Payroll Period with Respect to an Employee is MONTHLY |

|

|

|

|

|

|

|

|

|

||||||||||

(a) SINGLE person |

|

|

|

|

|

|

(b) MARRIED person |

|

|

|

|

|

|

(c) HEAD of HOUSEHOLD person |

|

|

|

|

|||||||||||

If the amount |

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

||||||||||

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

|||||||||

Not Over |

$ |

577 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

1,154 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

867 |

|

$0.00 |

|

|

|

|

|||

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

||||||||||||

$ |

577 |

$ |

1,035 |

|

|

|

1.7% |

$ |

577 |

$ |

1,154 |

$ |

1,821 |

|

|

|

1.7% |

$ |

1,154 |

$ |

867 |

$ |

1,533 |

|

|

|

1.7% |

$ |

867 |

$ |

1,035 |

$ |

1,494 |

$ |

7.79 |

+ |

3.2% |

$ |

1,035 |

$ |

1,821 |

$ |

2,488 |

$ |

11.33 |

+ |

3.2% |

$ |

1,821 |

$ |

1,533 |

$ |

2,200 |

$ |

11.33 |

+ |

3.2% |

$ |

1,533 |

$ |

1,494 |

$ |

1,910 |

$ |

22.46 |

+ |

4.7% |

$ |

1,494 |

$ |

2,488 |

$ |

3,154 |

$ |

32.67 |

+ |

4.7% |

$ |

2,488 |

$ |

2,200 |

$ |

2,867 |

$ |

32.67 |

+ |

4.7% |

$ |

2,200 |

$ |

1,910 |

$ |

2,744 |

$ |

42.04 |

+ |

4.9% |

$ |

1,910 |

$ |

3,154 |

$ |

4,488 |

$ |

64.00 |

+ |

4.9% |

$ |

3,154 |

$ |

2,867 |

$ |

4,200 |

$ |

64.00 |

+ |

4.9% |

$ |

2,867 |

$ |

2,744 |

$ |

4,077 |

$ |

82.88 |

+ |

4.9% |

$ |

2,744 |

$ |

4,488 |

$ |

6,488 |

$ |

129.33 |

+ |

4.9% |

$ |

4,488 |

$ |

4,200 |

$ |

6,200 |

$ |

129.33 |

+ |

4.9% |

$ |

4,200 |

$ |

4,077 |

$ |

5,994 |

$ |

148.21 |

+ |

4.9% |

$ |

4,077 |

$ |

6,488 |

$ |

9,488 |

$ |

227.33 |

+ |

4.9% |

$ |

6,488 |

$ |

6,200 |

$ |

9,200 |

$ |

227.33 |

+ |

4.9% |

$ |

6,200 |

$ |

5,994 |

$ |

10,994 |

$ |

242.13 |

+ |

4.9% |

$ |

5,994 |

$ |

9,488 |

$ |

17,821 |

$ |

374.33 |

+ |

4.9% |

$ |

9,488 |

$ |

9,200 |

$ |

17,533 |

$ |

374.33 |

+ |

4.9% |

$ |

9,200 |

$ |

10,994 |

$ |

18,077 |

$ |

487.13 |

+ |

4.9% |

$ |

10,994 |

$ |

17,821 |

$ |

27,404 |

$ |

782.67 |

+ |

4.9% |

$ |

17,821 |

$ |

17,533 |

$ |

27,117 |

$ |

782.67 |

+ |

4.9% |

$ |

17,533 |

$ |

18,077 |

|

and over |

$ |

834.21 |

+ |

5.9% |

$ |

18,077 |

$ |

27,404 |

|

and over |

$ |

1,252.25 |

+ |

5.9% |

$ |

27,404 |

$ |

27,117 |

|

and over |

$ |

1,252.25 |

+ |

5.9% |

$ |

27,117 |

New Mexico Taxation and Revenue Department

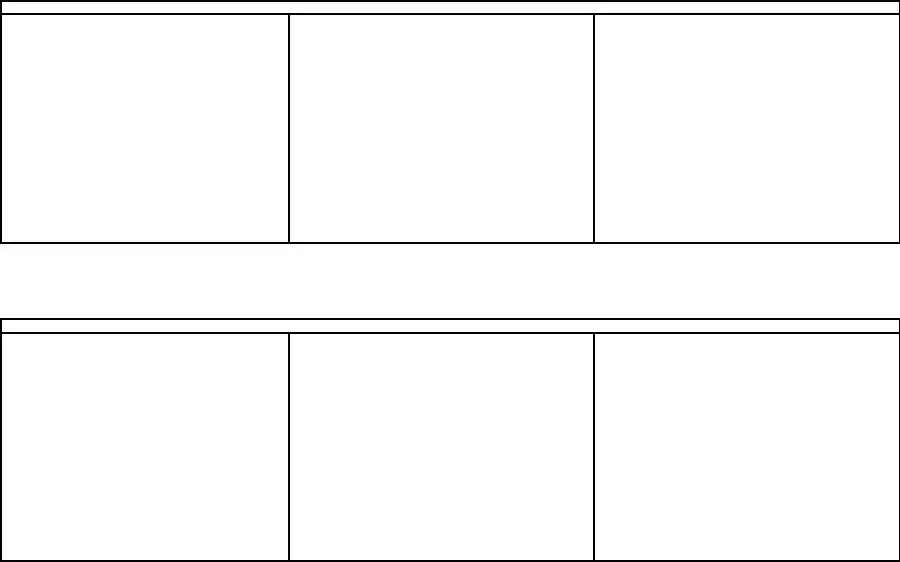

New Mexico State Wage Withholding Tax Tables for Percentage Method of Withholding

(For wages paid on or after January 1, 2023)

|

|

|

|

|

|

|

|

|

Table 5 - If the Payroll Period with Respect to an Employee is QUARTERLY |

|

|

|

|

|

|

|

|

||||||||||||

(a) SINGLE person |

|

|

|

|

|

|

(b) MARRIED person |

|

|

|

|

|

|

(c) HEAD of HOUSEHOLD person |

|

|

|

|

|||||||||||

If the amount |

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

||||||||||

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

|||||||||

Not Over |

$ |

1,731 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

3,463 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

2,600 |

|

$0.00 |

|

|

|

|

|||

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

||||||||||||

$ |

1,731 |

$ |

3,106 |

|

|

|

1.7% |

$ |

1,731 |

$ |

3,463 |

$ |

5,463 |

|

|

|

1.7% |

$ |

3,463 |

$ |

2,600 |

$ |

4,600 |

|

|

|

1.7% |

$ |

2,600 |

$ |

3,106 |

$ |

4,481 |

$ |

23.38 |

+ |

3.2% |

$ |

3,106 |

$ |

5,463 |

$ |

7,463 |

$ |

34.00 |

+ |

3.2% |

$ |

5,463 |

$ |

4,600 |

$ |

6,600 |

$ |

34.00 |

+ |

3.2% |

$ |

4,600 |

$ |

4,481 |

$ |

5,731 |

$ |

67.38 |

+ |

4.7% |

$ |

4,481 |

$ |

7,463 |

$ |

9,463 |

$ |

98.00 |

+ |

4.7% |

$ |

7,463 |

$ |

6,600 |

$ |

8,600 |

$ |

98.00 |

+ |

4.7% |

$ |

6,600 |

$ |

5,731 |

$ |

8,231 |

$ |

126.13 |

+ |

4.9% |

$ |

5,731 |

$ |

9,463 |

$ |

13,463 |

$ |

192.00 |

+ |

4.9% |

$ |

9,463 |

$ |

8,600 |

$ |

12,600 |

$ |

192.00 |

+ |

4.9% |

$ |

8,600 |

$ |

8,231 |

$ |

12,231 |

$ |

248.63 |

+ |

4.9% |

$ |

8,231 |

$ |

13,463 |

$ |

19,463 |

$ |

388.00 |

+ |

4.9% |

$ |

13,463 |

$ |

12,600 |

$ |

18,600 |

$ |

388.00 |

+ |

4.9% |

$ |

12,600 |

$ |

12,231 |

$ |

17,981 |

$ |

444.63 |

+ |

4.9% |

$ |

12,231 |

$ |

19,463 |

$ |

28,463 |

$ |

682.00 |

+ |

4.9% |

$ |

19,463 |

$ |

18,600 |

$ |

27,600 |

$ |

682.00 |

+ |

4.9% |

$ |

18,600 |

$ |

17,981 |

$ |

32,981 |

$ |

726.38 |

+ |

4.9% |

$ |

17,981 |

$ |

28,463 |

$ |

53,463 |

$ |

1,123.00 |

+ |

4.9% |

$ |

28,463 |

$ |

27,600 |

$ |

52,600 |

$ |

1,123.00 |

+ |

4.9% |

$ |

27,600 |

$ |

32,981 |

$ |

54,231 |

$ |

1,461.38 |

+ |

4.9% |

$ |

32,981 |

$ |

53,463 |

$ |

82,213 |

$ |

2,348.00 |

+ |

4.9% |

$ |

53,463 |

$ |

52,600 |

$ |

81,350 |

$ |

2,348.00 |

+ |

4.9% |

$ |

52,600 |

$ |

54,231 |

|

and over |

$ |

2,502.63 |

+ |

5.9% |

$ |

54,231 |

$ |

82,213 |

|

and over |

$ |

3,756.75 |

+ |

5.9% |

$ |

82,213 |

$ |

81,350 |

|

and over |

$ |

3,756.75 |

+ |

5.9% |

$ |

81,350 |

|

|

|

|

|

|

|

|

|

Table 6 - If the Payroll Period with Respect to an Employee is |

|

|

|

|

|

|

|

|

||||||||||||

(a) SINGLE person |

|

|

|

|

|

|

(b) MARRIED person |

|

|

|

|

|

|

(c) HEAD of HOUSEHOLD person |

|

|

|

|

|||||||||||

If the amount |

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

||||||||||

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

|||||||||

Not Over |

$ |

3,463 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

6,925 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

5,200 |

|

$0.00 |

|

|

|

|

|||

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

||||||||||||

$ |

3,463 |

$ |

6,213 |

|

|

|

1.7% |

$ |

3,463 |

$ |

6,925 |

$ |

10,925 |

|

|

|

1.7% |

$ |

6,925 |

$ |

5,200 |

$ |

9,200 |

|

|

|

1.7% |

$ |

5,200 |

$ |

6,213 |

$ |

8,963 |

$ |

46.75 |

+ |

3.2% |

$ |

6,213 |

$ |

10,925 |

$ |

14,925 |

$ |

68.00 |

+ |

3.2% |

$ |

10,925 |

$ |

9,200 |

$ |

13,200 |

$ |

68.00 |

+ |

3.2% |

$ |

9,200 |

$ |

8,963 |

$ |

11,463 |

$ |

134.75 |

+ |

4.7% |

$ |

8,963 |

$ |

14,925 |

$ |

18,925 |

$ |

196.00 |

+ |

4.7% |

$ |

14,925 |

$ |

13,200 |

$ |

17,200 |

$ |

196.00 |

+ |

4.7% |

$ |

13,200 |

$ |

11,463 |

$ |

16,463 |

$ |

252.25 |

+ |

4.9% |

$ |

11,463 |

$ |

18,925 |

$ |

26,925 |

$ |

384.00 |

+ |

4.9% |

$ |

18,925 |

$ |

17,200 |

$ |

25,200 |

$ |

384.00 |

+ |

4.9% |

$ |

17,200 |

$ |

16,463 |

$ |

24,463 |

$ |

497.25 |

+ |

4.9% |

$ |

16,463 |

$ |

26,925 |

$ |

38,925 |

$ |

776.00 |

+ |

4.9% |

$ |

26,925 |

$ |

25,200 |

$ |

37,200 |

$ |

776.00 |

+ |

4.9% |

$ |

25,200 |

$ |

24,463 |

$ |

35,963 |

$ |

889.25 |

+ |

4.9% |

$ |

24,463 |

$ |

38,925 |

$ |

56,925 |

$ |

1,364.00 |

+ |

4.9% |

$ |

38,925 |

$ |

37,200 |

$ |

55,200 |

$ |

1,364.00 |

+ |

4.9% |

$ |

37,200 |

$ |

35,963 |

$ |

65,963 |

$ |

1,452.75 |

+ |

4.9% |

$ |

35,963 |

$ |

56,925 |

$ |

106,925 |

$ |

2,246.00 |

+ |

4.9% |

$ |

56,925 |

$ |

55,200 |

$ |

105,200 |

$ |

2,246.00 |

+ |

4.9% |

$ |

55,200 |

$ |

65,963 |

$ |

108,463 |

$ |

2,922.75 |

+ |

4.9% |

$ |

65,963 |

$ |

106,925 |

$ |

164,425 |

$ |

4,696.00 |

+ |

4.9% |

$ |

106,925 |

$ |

105,200 |

$ |

162,700 |

$ |

4,696.00 |

+ |

4.9% |

$ |

105,200 |

$ |

108,463 |

|

and over |

$ |

5,005.25 |

+ |

5.9% |

$ |

108,463 |

$ |

164,425 |

|

and over |

$ |

7,513.50 |

+ |

5.9% |

$ |

164,425 |

$ |

162,700 |

|

and over |

$ |

7,513.50 |

+ |

5.9% |

$ |

162,700 |

New Mexico Taxation and Revenue Department

New Mexico State Wage Withholding Tax Tables for Percentage Method of Withholding

(For wages paid on or after January 1, 2023)

|

|

|

|

|

|

|

|

|

|

Table 7 - If the Payroll Period with Respect to an Employee is ANNUAL |

|

|

|

|

|

|

|

|

|||||||||||

(a) SINGLE person |

|

|

|

|

|

|

(b) MARRIED person |

|

|

|

|

|

|

(c) HEAD of HOUSEHOLD person |

|

|

|

|

|||||||||||

If the amount |

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

||||||||||

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

|||||||||

Not Over |

$ |

6,925 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

13,850 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

10,400 |

|

$0.00 |

|

|

|

|

|||

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

||||||||||||

$ |

6,925 |

$ |

12,425 |

|

|

|

1.7% |

$ |

6,925 |

$ |

13,850 |

$ |

21,850 |

|

|

|

1.7% |

$ |

13,850 |

$ |

10,400 |

$ |

18,400 |

|

|

|

1.7% |

$ |

10,400 |

$ |

12,425 |

$ |

17,925 |

$ |

93.50 |

+ |

3.2% |

$ |

12,425 |

$ |

21,850 |

$ |

29,850 |

$ |

136.00 |

+ |

3.2% |

$ |

21,850 |

$ |

18,400 |

$ |

26,400 |

$ |

136.00 |

+ |

3.2% |

$ |

18,400 |

$ |

17,925 |

$ |

22,925 |

$ |

269.50 |

+ |

4.7% |

$ |

17,925 |

$ |

29,850 |

$ |

37,850 |

$ |

392.00 |

+ |

4.7% |

$ |

29,850 |

$ |

26,400 |

$ |

34,400 |

$ |

392.00 |

+ |

4.7% |

$ |

26,400 |

$ |

22,925 |

$ |

32,925 |

$ |

504.50 |

+ |

4.9% |

$ |

22,925 |

$ |

37,850 |

$ |

53,850 |

$ |

768.00 |

+ |

4.9% |

$ |

37,850 |

$ |

34,400 |

$ |

50,400 |

$ |

768.00 |

+ |

4.9% |

$ |

34,400 |

$ |

32,925 |

$ |

48,925 |

$ |

994.50 |

+ |

4.9% |

$ |

32,925 |

$ |

53,850 |

$ |

77,850 |

$ |

1,552.00 |

+ |

4.9% |

$ |

53,850 |

$ |

50,400 |

$ |

74,400 |

$ |

1,552.00 |

+ |

4.9% |

$ |

50,400 |

$ |

48,925 |

$ |

71,925 |

$ |

1,778.50 |

+ |

4.9% |

$ |

48,925 |

$ |

77,850 |

$ |

113,850 |

$ |

2,728.00 |

+ |

4.9% |

$ |

77,850 |

$ |

74,400 |

$ |

110,400 |

$ |

2,728.00 |

+ |

4.9% |

$ |

74,400 |

$ |

71,925 |

$ |

131,925 |

$ |

2,905.50 |

+ |

4.9% |

$ |

71,925 |

$ |

113,850 |

$ |

213,850 |

$ |

4,492.00 |

+ |

4.9% |

$ |

113,850 |

$ |

110,400 |

$ |

210,400 |

$ |

4,492.00 |

+ |

4.9% |

$ |

110,400 |

$ |

131,925 |

$ |

216,925 |

$ |

5,845.50 |

+ |

4.9% |

$ |

131,925 |

$ |

213,850 |

$ |

328,850 |

$ |

9,392.00 |

+ |

4.9% |

$ |

213,850 |

$ |

210,400 |

$ |

325,400 |

$ |

9,392.00 |

+ |

4.9% |

$ |

210,400 |

$ |

216,925 |

|

and over |

$ 10,010.50 |

+ |

5.9% |

$ |

216,925 |

$ |

328,850 |

|

and over |

$ 15,027.00 |

+ |

5.9% |

$ |

328,850 |

$ |

325,400 |

|

and over |

$ 15,027.00 |

+ |

5.9% |

$ |

325,400 |

|||

|

|

|

|

|

|

|

|

Table 8 - If the Payroll Period with Respect to an Employee is DAILY or MISCELLANEOUS |

|

|

|

|

|

|

|

||||||||||||||

(a) SINGLE person |

|

|

|

|

|

|

(b) MARRIED person |

|

|

|

|

|

|

(c) HEAD of HOUSEHOLD person |

|

|

|

|

|||||||||||

If the amount |

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

If the amount |

|

|

|

The amount of state |

|

|

||||||||||

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

of wages is: |

|

|

|

tax withheld shall be: |

|

|

|||||||||

Not Over |

$ |

26.60 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

53.30 |

|

$0.00 |

|

|

|

|

Not Over |

$ |

40.00 |

|

$0.00 |

|

|

|

|

|||

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

Over: |

But not over: |

|

|

|

of excess over - |

||||||||||||

$ |

26.60 |

$ |

47.80 |

|

|

|

1.7% |

$ |

26.60 |

$ |

53.30 |

$ |

84.00 |

|

|

|

1.7% |

$ |

53.30 |

$ |

40.00 |

$ |

70.80 |

|

|

|

1.7% |

$ |

40.00 |

$ |

47.80 |

$ |

68.90 |

$ |

0.36 |

+ |

3.2% |

$ |

47.80 |

$ |

84.00 |

$ |

114.80 |

$ |

0.52 |

+ |

3.2% |

$ |

84.00 |

$ |

70.80 |

$ |

101.50 |

$ |

0.52 |

+ |

3.2% |

$ |

70.80 |

$ |

68.90 |

$ |

88.20 |

$ |

1.04 |

+ |

4.7% |

$ |

68.90 |

$ |

114.80 |

$ |

145.60 |

$ |

1.51 |

+ |

4.7% |

$ |

114.80 |

$ |

101.50 |

$ |

132.30 |

$ |

1.51 |

+ |

4.7% |

$ |

101.50 |

$ |

88.20 |

$ |

126.60 |

$ |

1.94 |

+ |

4.9% |

$ |

88.20 |

$ |

145.60 |

$ |

207.10 |

$ |

2.95 |

+ |

4.9% |

$ |

145.60 |

$ |

132.30 |

$ |

193.80 |

$ |

2.95 |

+ |

4.9% |

$ |

132.30 |

$ |

126.60 |

$ |

188.20 |

$ |

3.83 |

+ |

4.9% |

$ |

126.60 |

$ |

207.10 |

$ |

299.40 |

$ |

5.97 |

+ |

4.9% |

$ |

207.10 |

$ |

193.80 |

$ |

286.20 |

$ |

5.97 |

+ |

4.9% |

$ |

193.80 |

$ |

188.20 |

$ |

276.60 |

$ |

6.84 |

+ |

4.9% |

$ |

188.20 |

$ |

299.40 |

$ |

437.90 |

$ |

10.49 |

+ |

4.9% |

$ |

299.40 |

$ |

286.20 |

$ |

424.60 |

$ |

10.49 |

+ |

4.9% |

$ |

286.20 |

$ |

276.60 |

$ |

507.40 |

$ |

11.18 |

+ |

4.9% |

$ |

276.60 |

$ |

437.90 |

$ |

822.50 |

$ |

17.28 |

+ |

4.9% |

$ |

437.90 |

$ |

424.60 |

$ |

809.20 |

$ |

17.28 |

+ |

4.9% |

$ |

424.60 |

$ |

507.40 |

$ |

834.30 |

$ |

22.48 |

+ |

4.9% |

$ |

507.40 |

$ |

822.50 |

$ 1,264.80 |

$ |

36.12 |

+ |

4.9% |

$ |

822.50 |

$ |

809.20 |

$ 1,251.50 |

$ |

36.12 |

+ |

4.9% |

$ |

809.20 |

||

$ |

834.30 |

|

and over |

$ |

38.50 |

+ |

5.9% |

$ |

834.30 |

$ |

1,264.80 |

|

and over |

$ |

57.80 |

+ |

5.9% |

$ |

1,264.80 |

$ |

1,251.50 |

|

and over |

$ |

57.80 |

+ |

5.9% |

$ |

1,251.50 |

New Mexico Taxation and Revenue Department

TAXPAYER INFORMATION

General Information. FYIs and Bulletins present general information with minimum technical language. All FYIs and Bulletins are free of charge and available through all local tax offices and on the Taxation and Revenue Department’s website at

Regulations. The Department establishes regulations to interpret and exemplify the various tax acts it administers. Current statutes with regulations can be located on the Departments website for free at

The Taxation and Revenue Department regulation book is available for purchase from the New Mexico Compilation Commission. Order regulation books directly from the New Mexico Compilation Commission at https://www.nmcompcomm.us/

Rulings. Rulings signed by the Secretary and approved by the Attorney General are written statements that apply to one or a small number of taxpayers. A taxpayer may request a ruling (at no charge) to clarify its tax liability or responsibility under specific circumstances. The Department will not issue a ruling to a taxpayer who is undergoing an audit, who has an outstanding assessment, or who is involved in a protest or litigation with the Department over the subject matter of the request. The Department’s rulings are compiled and available on free of charge at http://www.tax.newmexico.gov/rulings.aspx.

The request for a ruling must be in writing, include accurate taxpayer identification and the details about the taxpayer’s situation, and be addressed to the Secretary of the Taxation and Revenue Department at P.O. Box 630, Santa Fe, NM

The Secretary may modify or withdraw any previously issued ruling and is required to withdraw or modify any ruling when subsequent legislation, regulations, final court decisions or other rulings invalidate a ruling or portions of a ruling.

Public Decisions & Orders. All public decisions and orders issued since July 1994 are compiled and available on the Department’s web page free of charge at

This publication provides general information. It does not constitute a regulation, ruling, or decision issued by the Secretary of the New Mexico Taxation and Revenue Department. The Department is legally bound only by a regulation or a ruling

New Mexico Taxation and Revenue Department

FOR FURTHER ASSISTANCE

Tax District Field Offices and the Department’s call center can provide full service and general information about the Department's taxes, taxpayer access point, programs, classes, and forms. Information specific to your filing situation, payment plans and delinquent accounts.

TAX DISTRICT FIELD OFFICES

ALBUQUERQUE

10500 Copper Pointe Avenue NE Albuquerque, NM 87123

SANTA FE

Manuel Lujan Sr. Bldg.

1200 S. St. Francis Dr.

Santa Fe, NM 87504

FARMINGTON

3501 E. Main St., Suite N

Farmington, NM 87499

LAS CRUCES

2540 S. El Paseo Bldg. #2

Las Cruces, NM 88004

ROSWELL

400 Pennsylvania Ave., Suite 200 Roswell, NM 8820

For forms and instructions visit the Department’s web site at http://www.tax.newmexico.gov

Call Center Number:

If faxing something to a tax district field office, please fax to:

Call Center Fax Number:

If mailing information to a tax district field office, please mail to:

Taxation and Revenue Department

P.O. Box 8485

Albuquerque, NM

For additional contact information please visit the Department’s website at

This information is as accurate as possible as of the date specified on the publication. Subsequent legislation, new state regulations and case law may affect its accuracy. For the latest information please check the Taxation and Revenue Department’s web site at www.tax.newmexico.gov.

This publication provides general information. It does not constitute a regulation, ruling, or decision issued by the Secretary of the New Mexico Taxation and Revenue Department. The Department is legally bound only by a regulation or a ruling

Document Properties

| Fact | Detail |

|---|---|

| Governing Law | New Mexico Taxation and Revenue Department regulations and guidelines |

| Effective Date | January 1, 2022 |

| Adjustments for Allowances | No longer adjustments made for allowances on New Mexico withholding due to federal form changes in 2020 |

| Usage of Federal W-4 | New Mexico does not have a state-specific form and uses Federal Form W-4, marked "For New Mexico State Withholding Only" for convenience |

| Withholding Tax Tables | Provides tax tables for the percentage method of withholding for calculating New Mexico state withholding tax |

Steps to Filling Out New Mexico Withholding

Fulfilling individual tax obligations can sometimes be a daunting task, especially when dealing with state-specific documentation. In New Mexico, the process of withholding state income tax from wages, gambling winnings, and other earnings is governed by specific guidelines. The following steps are designed to simplify the process of completing necessary forms for New Mexico withholding, to ensure compliance and accuracy in fulfilling state tax requirements.

- First, secure a copy of the Federal Form W-4. Although New Mexico does not have a state-specific W-4 form, this document is utilized for withholding tax purposes within the state. Ensure that "For New Mexico State Withholding Only" is written across the top in bold letters.

- If the W-4 form being used is pre-2020, employees should continue to use the correct number of withholding allowances. Despite changes in federal tax law, these allowances remain relevant for state withholding calculations.

- For employees with income exempt from New Mexico tax (e.g., Native Americans living and working within their tribal land, military service members on active duty), it's crucial to indicate such exemptions appropriately on the W-4 form to prevent state tax withholding.

- Refer to the New Mexico State Wage Withholding Tax Tables provided by the New Mexico Taxation and Revenue Department for the percentage method of withholding. These tables are imperative for correctly determining the amount of tax to withhold from each payment period.

- Use the tax tables starting on page 5 of the publication to calculate the withholding amount based on the employee's taxable wages, filing status, and pay period frequency (e.g., weekly, bi-weekly).

- For those employees requesting additional withholding amounts beyond their calculated tax liability, such requests should be documented on their New Mexico withholding W-4. This is a consideration often made to accommodate personal financial planning needs.

- After calculating withholding amounts, including any additional requested withholding, report and submit these taxes to the New Mexico Taxation and Revenue Department. As of July 1, 2021, use either the TRD-41414, Wage Withholding Tax Return or TRD-41409, Non-Wage Withholding Tax Return, depending on the nature of the income being reported. All returns can be filed online through the state's taxpayer access point (TAP) portal.

- Ensure that all forms are completed accurately and filed timely. The due date for tax submissions is the 25th of the month following the end of the reporting period. In instances where the 25th falls on a weekend or legal holiday, the next business day serves as the due date.

- Lastly, keep detailed records of all withholding tax calculations, submissions, and employee declarations. These documents are essential for verifying compliance with New Mexico tax laws and facilitating any future inquiries from either the employees or the tax authority.

Completing the New Mexico withholding tax forms with diligence and attention to detail ensures that employers accurately withhold and remit taxes on behalf of their employees, thereby upholding their tax obligations within the state. This structured approach not only simplifies the process for employers but also provides a clear pathway for compliance, benefiting all parties involved.

Frequently Asked Questions

What has changed in the New Mexico Withholding Forms starting 2020?

Starting in 2020, adjustments to New Mexico withholding due to the number of allowances taken on pre-2020 Federal Form W-4 have been eliminated. Despite these changes, employees can still use any version of the Federal Form W-4 for New Mexico withholding purposes, explicitly writing "For New Mexico State Withholding Only" on the form. This change aims to simplify the withholding process and ensure that employees' withholding aligns more closely with their New Mexico income tax liability.

Who is required to withhold New Mexico income tax?

All employers who withhold federal income tax from an employee's wages must also withhold New Mexico income tax. This includes those who pay wages for services performed within New Mexico, as well as certain payers of pensions, annuities, and gambling winnings. The requirement covers a broad scope of individuals and entities, ensuring fair and consistent withholding across different sources of income.

How should employers determine the amount to withhold for New Mexico income tax?

Employers must refer to the New Mexico State Wage Withholding Tax Tables for the Percentage Method of Withholding provided in the publication. These tables help calculate the withholding amount based on the employee’s pay period and filing status. Employers should accurately determine taxable wages and then use the specified table to find the correct withholding amount, considering any additional withholding requested by the employee.

What are the reporting and payment requirements for New Mexico withholding taxes?

Employers need to use specific forms for reporting New Mexico withholding taxes—TRD-41414 for wage withholding and TRD-41409 for non-wage withholding, like gambling winnings. Reports and payments are due on the 25th of the month following the reporting period. Employers can file these forms online, ensuring that taxes are reported and paid timely. Filing a "zero" report is necessary even if no tax is due, and employers must not mail cash payments to the Department.

Can additional amounts be withheld for New Mexico income tax purposes?

Yes, employees may request to have additional amounts withheld from their paychecks for state taxes. This is an important option for individuals who wish to ensure that enough tax is being withheld to cover their New Mexico income tax liability, especially if their financial or personal situation changes.

How are gambling winnings treated under New Mexico withholding tax?

Operators of gambling establishments must withhold 6% from winnings and report these amounts using the specified non-wage withholding tax forms. This requirement ensures that taxes on gambling winnings are collected and reported accurately, both for residents and nonresidents of New Mexico.

What is the procedure for annual withholding statements and reconciliation in New Mexico?

Employers who have withheld state taxes must file an annual statement of withholding by the end of January for each employee or payee. New Mexico accepts the state copy of federal forms like W-2 and 1099-R, as long as they include the required income and withholding information. Additionally, taxpayers may use Form RPD-41072 for annual summary and reconciliation, helping ensure that the amounts withheld match the total tax reported and paid to the state.

Common mistakes

Filling out tax forms can sometimes feel like trying to navigate a maze in the dark. This is especially true when it comes to filling out withholding forms for New Mexico. To make this task a bit lighter, let’s illuminate the common mistakes people make on the New Mexico Withholding form so you can steer clear of them:

- Not updating form for post-2020 changes: With the Federal Form W-4 changes in 2020, which removed allowances, many employees neglect to review and adjust their New Mexico withholding setup accordingly. New Mexico's state withholding tables should be used, regardless of the W-4 version.

- Employers failing to communicate changes: Since New Mexico withholding tax has undergone modifications—like no longer adjusting due to the number of allowances—it remains crucial for employers to inform their team. This helps employees understand potential increases in their withholding tax.

- Overlooking exempt income: Employees with income exempt from New Mexico tax, such as Native Americans working on their tribal land or military members with active-duty pay, mistakenly have tax withheld when indicating "exempt" status could avoid it.

- Not specifying New Mexico on the W-4: When a dual-purpose Federal Form W-4 is used for state withholding, failing to write "For New Mexico State Withholding Only" across the top can cause confusion and improper filing.

- Incorrect filing status or paycheck frequency: Misinterpreting the paycheck frequency or filing status on the withholding tables can lead to incorrect withholding amounts. This misstep can affect tax liabilities and refunds at the end of the year.

- Additional withholding not considered: Some employees forget to request additional withholding amounts for New Mexico, even though they might benefit from opting for additional federal withholdings to avoid potential tax liabilities.

- Inadequate withholding for supplemental wages: Employers not using the appropriate method to withhold taxes from supplemental wages, such as bonuses or overtime, can result in employees either overpaying or underpaying their state taxes.

- Failure to use updated tax tables: Relying on outdated withholding tax tables can lead to incorrect withholdings. The withholding tables provided in the latest New Mexico publication should be used to ensure accuracy.

- Error in annual reconciliation process: Not reconciling the total amounts of withheld state tax on withholding statements with the total tax withheld and paid to New Mexico might lead to complications. Filing amended returns when necessary and ensuring accurate totals are critical steps often overlooked.

Understanding and avoiding these mistakes can lead to a smoother experience with New Mexico's withholding tax. It ensures compliance, minimizes the likelihood of unexpected tax liabilities, and helps manage financial planning more effectively.

Documents used along the form

Accurate and timely tax documentation is vital for efficient payroll management and compliance with state regulations. In addition to the New Mexico Withholding Tax form (FYI-104), businesses often need to prepare and maintain several other documents to ensure accurate reporting and withholding of taxes. Each of these documents plays a unique role in the payroll and tax reporting process.

- Federal Form W-4: Used by employees to determine the amount of federal income tax to withhold from their wages. Although New Mexico does not have a state-specific W-4, employees can use the federal form for New Mexico state withholding purposes by indicating "For New Mexico State Withholding Only" on the form.

- Form CRS-1: Before the changes in July 2021, this form was used for reporting New Mexico withholding tax along with gross receipts and compensating tax. It highlights the integration of state tax reporting processes before recent adjustments.

- TRD-41414, Wage Withholding Tax Return: This form is used after July 1, 2021, for reporting taxes withheld from employee wages. It's crucial for businesses adjusting to the most current reporting requirements.

- TRD-41409, Non-Wage Withholding Tax Return: This form is specifically for reporting withholding taxes from non-wage sources, such as gambling winnings, pensions, and annuities. It applies to both before and after the July 1, 2021 changes.

- Form ACD-31015, Business Tax Registration and Update Form: Necessary for businesses to register for tax withholding, update their business information, or cancel their New Mexico Business Tax Identification Number.

- Form PIT-ES, Estimated Tax Payment Voucher: Used by individuals, including those who are self-employed, to make estimated tax payments. While not directly related to payroll withholding, it is relevant for self-employed individuals and business owners.

- Form RPD-41072, Annual Summary of Withholding Tax: Though not mandatory, this form helps businesses reconcile their withholding amounts at the end of the year, ensuring that the amounts withheld match what was actually paid.

- Form RPD-41071, Application for Refund: Used in conjunction with RPD-41072 if a business discovers it has overpaid on its withholding and seeks a refund.

- Annual Withholding Statements: These include forms like W-2, W-2G, 1099-R, and others, which businesses are required to file for each employee or contractor to whom they've paid wages or other earnings subject to state withholding.

Understanding and managing these forms effectively ensures businesses remain compliant with New Mexico's tax laws and regulations while minimizing potential legal and financial penalties. Utilizing these documents correctly plays a crucial role in the smooth operation of payroll processing and tax reporting for any business operating within New Mexico.

Similar forms

The New Mexico Withholding Tax form is similar to the Federal Form W-4 in several key aspects. Both are designed to instruct employers on how much tax to withhold from an employee's paycheck. Federal Form W-4 is used for federal income tax withholding, while the New Mexico form pertains to state income tax. The main function of these forms is to ensure that employees have the correct amount of tax withheld to cover their estimated tax liability for the year. This similarity extends to how the forms consider the filing status and income levels of the employee, though the specific details and tax rates will naturally differ between federal and state levels. Employees use both forms to claim allowances or exemptions and may also specify an additional dollar amount to withhold.

Another document the New Mexico Withholding Tax form aligns with is the employer's quarterly federal tax return, IRS Form 941. IRS Form 941 is used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. Additionally, it reports the employer's portion of social security or Medicare tax. The comparison lies in the purpose of reporting and paying withheld taxes to the respective tax authorities. While IRS Form 941 deals with federal withholdings, the function mirrors that of the processes outlined for New Mexico's withholding on a state level, focusing on ensuring that employers accurately report and submit withheld amounts on behalf of their employees.

Additionally, the New Mexico Withholding Tax form has parallels with IRS Form W-2. Form W-2 is used by employers to report an employee's annual earnings and the taxes withheld from their paycheck to the Internal Revenue Service. Both forms are critical at year-end to ensure employees can accurately report income and pay the correct amount of taxes. Where the New Mexico Withholding Tax form serves as a guide for how much state tax should be withheld from an employee’s paycheck through the year, Form W-2 summarizes the total income earned and the total state, federal, and other taxes withheld. This makes it essential for filing accurate annual tax returns, showcasing the intertwined nature of payroll documentation between state and federal tax responsibilities.

Dos and Don'ts

When dealing with the New Mexico Withholding Tax Form, it's important to ensure accuracy and compliance with state guidelines. Here are key dos and don'ts to consider:

Do:- Use the latest Federal Form W-4 for New Mexico withholding purposes. Mark it clearly with "For New Mexico State Withholding Only" to distinguish it for state tax purposes.

- Include additional withholding amounts if desired. If an employee wishes to have extra money withheld from their paycheck, they can request this on their New Mexico withholding W-4 form.

- Keep updated on changes to withholding requirements. Since tax laws and withholding requirements can change, regularly checking the New Mexico Taxation and Revenue Department website for updates is crucial.

- Ensure correct filing for exempt income. If an employee's income is exempt from New Mexico tax, such as certain Native Americans or military members, make sure this is correctly indicated on the withholding form to avoid unnecessary withholdings.

- Forget to adjust withholdings based on the state withholding tables. The withholding tables are essential for determining the correct amount to withhold from each paycheck.

- Overlook special withholding situations. Certain incomes, like gambling winnings, have specific withholding requirements. Ensure these are followed to stay compliant.

- Ignore the need for employees to review their withholdings. Encourage employees to check their withholding amounts regularly, especially after major life changes, to ensure they're not under or over-withholding.

- Miss the filing deadlines. Submitting withholding tax forms and payments after the due date can lead to penalties and interest charges.

Misconceptions

When it comes to understanding the ins and outs of the New Mexico Withholding Tax, many people find themselves tangled in misconceptions. Here are seven common ones, unpacked and explained for clarity.

- Misconception 1: You must use a special state form for New Mexico withholding.

- Misconception 2: Changes in federal withholding methods don't affect state withholding in New Mexico.

- Misconception 3: The number of allowances claimed doesn't matter anymore.

- Misconception 4: Non-resident employees always have New Mexico income tax withheld.

- Misconception 5: All types of income are subject to the same withholding rules.

- Misconception 6: You don’t have to report and pay withholding taxes if your business stops operating.

- Misconception 7: Supplementary wages and bonuses are taxed at the same rate as regular wages.

Contrary to this belief, employees can use any version of the Federal Form W-4 for New Mexico withholding purposes. They simply need to mark it clearly for state withholding use.

Actually, updates to federal withholding guidelines directly impact how withholding is calculated in New Mexico—the state's withholding tables now align with federal changes.

Even though allowances are less central after the federal tax law changes in 2020, correctly determining the number of allowances (for forms pre-2020) still influences your New Mexico withholding.

Employers aren't required to withhold New Mexico income tax for nonresident employees working in the state for 15 days or fewer within a calendar year.

Different rules apply for withholding on gambling winnings, pensions, and regular wages. For example, gambling establishments must withhold at a rate of 6% for certain winnings.

Even if a business ceases operations, there's still a requirement to report and pay any outstanding withholding taxes—businesses must formally notify the Taxation and Revenue Department to cancel their tax ID number.

For irregular or supplemental wages, withholding might need to be calculated differently, either using the percentage method tables provided or by adhering to special calculations for bonuses and similar types of income.