Fill Out a Valid Nm Fid 1 Template

The Nm FID 1 Form is a critical document for managing fiduciary income tax returns in New Mexico. This form is primarily used by the fiduciaries of estates and trusts to report income, deductions, and taxable income to the New Mexico Taxation and Revenue Department. It specifies that the original tax return and any taxes owed should be mailed by April 15, 2020, for the tax year 2019, with distinct guidelines for fiscal year estates and trusts. Featured within the document are sections for detailed information about the estate or trust, including the names and addresses of the fiduciary, details regarding the creation date of the trust or estate, and specifics surrounding the filing status such as final returns and amendments. It also includes provisions for calculating New Mexico taxable income, tax due, penalty, and interest, alongside sections dedicated to tax credits, payments, and withholding. Significantly, it outlines procedures for estates or trusts with income from both inside and outside New Mexico, introducing a nuanced calculation for the New Mexico percentage of income that factors in property, payroll, and sales percentages. Additional attention is given to direct deposit of refunds, indicating a modern approach to handling overpayments and refundable credits. Through its comprehensive structure, the Nm FID 1 Form embodies a rigorous process designed to ensure fiduciaries accurately fulfill their tax obligations while accommodating fiscal intricacies related to estate and trust management in New Mexico.

Document Preview

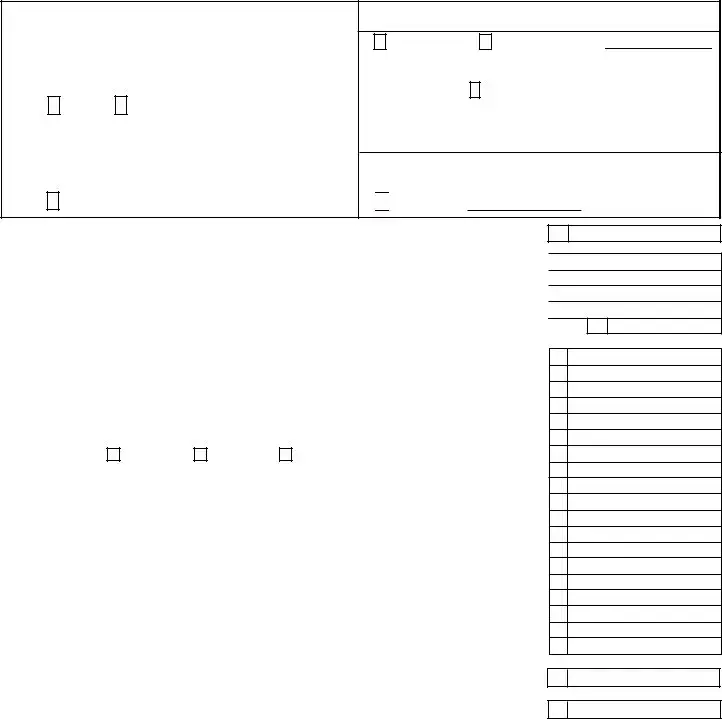

2019 |

NEW MEXICO |

*198080200* |

|

FIDUCIARY INCOME TAX RETURN

Mail the original return and tax due to the New Mexico Taxation and Revenue Department, P.O. Box 25127, Santa Fe, NM

A1

A3

A4

Name of estate or trust |

|

|

Name and title of fiduciary |

|

FOR DEPARTMENT |

|

|

|

|

|

|

|

USE ONLY |

|

|

A2 |

|

|

|

|

|

|

|

|

|

|

|

Address of fiduciary - (Number and street) |

City |

|

|

State |

Postal/ZIP code |

|

|

|

|

|

|

||

If foreign address, enter country |

Foreign province and/or state |

|

|

|||

|

|

|

|

|

|

|

B.DATE TRUST OR ESTATE CREATED. ____________________

C.If this is a final fiduciary return, enter liquidation or distribution date.

____________________

D.Has an adjustment to your federal taxable income for any prior year by the Internal Revenue Service not been reported to New Mexico?

YES |

NO |

If yes, you must submit an amended New Mexico return.

E.If you owe penalty on underpayment of estimated tax and you qualify for a special calculation method, enter 1, 2, 3, 4, or 5 in the box, and

ATTACH Form

Federal Employer Identification Number of estate or trust (Required)

F1 |

|

Calender year |

F2 |

Fiscal year beginning |

F3 |

|||||

|

|

ending |

and ending |

F4 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECK APPLICABLE BOXES |

|||||||

G1 |

|

Amended |

G2 |

Simple Trust |

G3 |

|

If a New Mexico resident |

|||

|

|

|

|

|

|

|

|

trust or estate, mark the box. |

||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

G4 |

|

ESTATE |

G5 |

|

Complex Trust |

G6 |

|

Grantor Trust |

||

|

|

|

|

|

|

|

|

|

|

|

EXTENSION OF TIME TO FILE. If you have a federal or New Mexico state extension, mark the box and enter the extension date.

H1

Extended to: H2

Extended to: H2

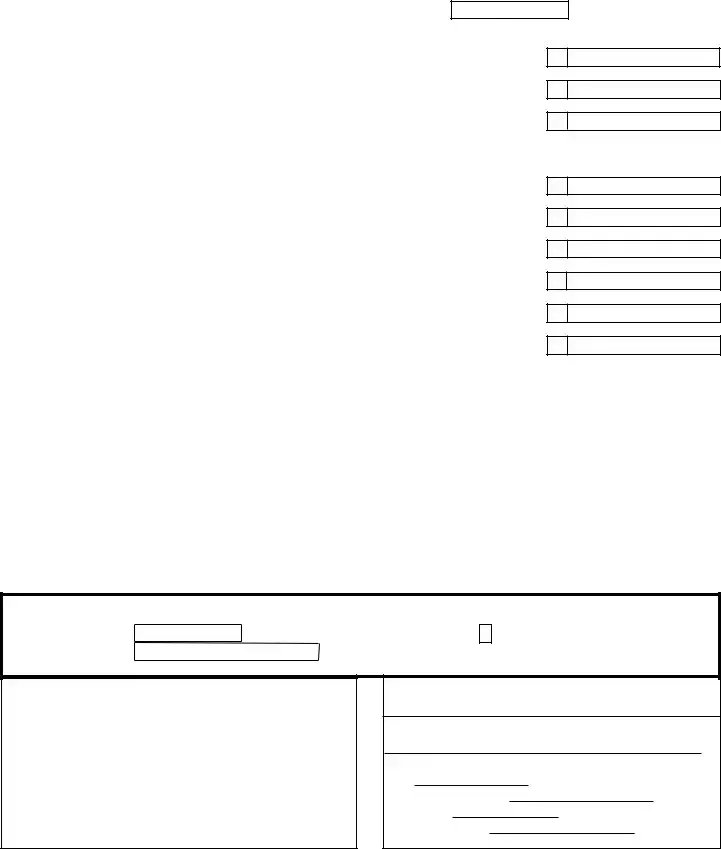

1. Federal taxable income of fiduciary (Sec. 641(c) federal taxable income ________________ )..............

1

2. |

.................................................................Additions to federal income (from |

+ |

2 |

|||

3. |

Deductions from federal income (from |

- |

3 |

|||

4. New Mexico taxable income. Add lines 1 and 2, then subtract line 3 |

= |

4 |

||||

5. Tax on line 4 amount. Use the Tax Rate Table in |

|

5 |

||||

6. |

.................................................New Mexico percentage of income (from |

|

|

|||

7. |

New Mexico income tax. Multiply line 5 by the percentage on line 6 and enter here. |

|

|

|||

|

If you do not need to complete Form |

7 |

||||

8. |

Tax on |

8 |

||||

9. |

Total New Mexico tax. Add lines 7 and 8 |

9 |

||||

10. |

Credit for taxes paid to another state (worksheet in instructions). Include other state return copy |

10 |

||||

11. |

Total credits applied against the income tax liability due (from |

11 |

||||

12. |

Net New Mexico income tax. Add lines 10 and 11, then subtract from line 9. Cannot be less than zero |

12 |

||||

13. |

Total Payments. |

Estimated |

Extension |

Applied from prior year |

13 |

|

14. |

New Mexico income tax withheld not included on lines 15 and 16. Attach annual statements |

14 |

||||

15. |

New Mexico income tax withheld from oil and gas proceeds. Attach |

15 |

||||

16. |

New Mexico income tax withheld from a |

16 |

||||

17. |

Amount from lines 15 and 16 passed to beneficiaries (reported on Form |

17 |

||||

18. |

Total payments and tax withheld. Subtract line 17 from the sum of lines 13 through 16 |

18 |

||||

19. |

Tax Due. If line 12 is more than line 18, enter the tax due |

19 |

||||

20. |

Penalty. See instructions |

|

+ 20 |

|||

21. |

Interest. See instructions |

|

+ 21 |

|||

22. |

Total amount due. Add lines 19, 20, and 21 |

= 22 |

||||

23. |

Overpayment. If line 18 is more than line 12, enter the difference |

23 |

||||

|

23a. Amount of overpayment to apply to 2020 liability. Cannot be more than line 23 |

|

23a |

|||

|

23b. Amount of overpayment to refund. Subtract line 23a from line 23 |

|

23b |

|||

24.Total portion of tax credits to be refunded

(from

25. Total refund of overpaid tax and refundable credit due to you. Add lines 23b and 24 .....................................

6

_ _ _ . _ _ _ _%

Name of estate or trust as shown on Form |

*198090200* |

|

2019 |

|

|

NEW MEXICO FIDUCIARY INCOME TAX RETURN |

|

|

|

|

FEIN of estate or trust |

|

|

|

|

|

|

ADDITIONS TO FEDERAL INCOME FOR FIDUCIARY

1. Federal net operating loss carryover ...............................................................................

2. |

....................................................................... |

+ |

|

|

|

1

2

3. Total additions. Add lines 1 and 2, then enter on |

= |

|

DEDUCTIONS FROM FEDERAL INCOME FOR FIDUCIARY |

|

|

|

||

4. New Mexico net operating loss (Attach |

|

|

5. |

Interest income from U. S. government obligations |

+ |

6. Net capital gain deduction. See instructions |

+ |

|

|

|

|

7. |

Deduction for income set aside for future distribution from an estate or trust to a |

|

|

nonresident individual |

+ |

8. |

Total deductions. Add lines 4, 5, 6, and 7. Enter on |

= |

9.Total distributions of income to beneficiaries. Enter the amount reported on Schedule

3

4

5

6

7

8

9

Important: On Schedule

Annual Withholding of Net Income From a

* * * * IMPORTANT NOTICE * * * *

The fiduciary of any grantor trust required to file federal Form 1041 under the provisions of federal

regulation

!!REFUND EXPRESS !! HAVE YOUR REFUND DIRECTLY DEPOSITED. SEE INSTRUCTIONS AND FILL IN 1, 2, 3, AND 4.

RE1 |

1. Routing number: |

RE3 3. Type: Checking |

|

Savings |

|

||||

RE2 |

2. Account number: |

Enter X |

|

Enter X |

|

4.REQUIRED: WILL THIS REFUND GO TO OR THROUGH AN ACCOUNT LOCATED OUTSIDE THE UNITED STATES? If yes, you may not use THIS

refund delivery option. See instructions.

RE4 YES |

|

NO |

|

You must answer |

|

|

this question. |

||

|

|

|

|

I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer or an employee of the taxpayer) is based on all information of which preparer has any knowledge.

Taxpayer's signature

|

Signature of fiduciary or officer representing fiduciary |

Date |

|

|

|

|

|

|

Title |

Contact phone number |

|

|

|

|

|

Taxpayer's email address |

|

|

|

P1

P2

P3

P4

P5

Paid preparer's use only:

Signature of preparer if other than employee of the taxpayer |

Date |

Print preparer's name

FEIN

NM CRS Identification Number

Preparer's PTIN

Preparer's phone number

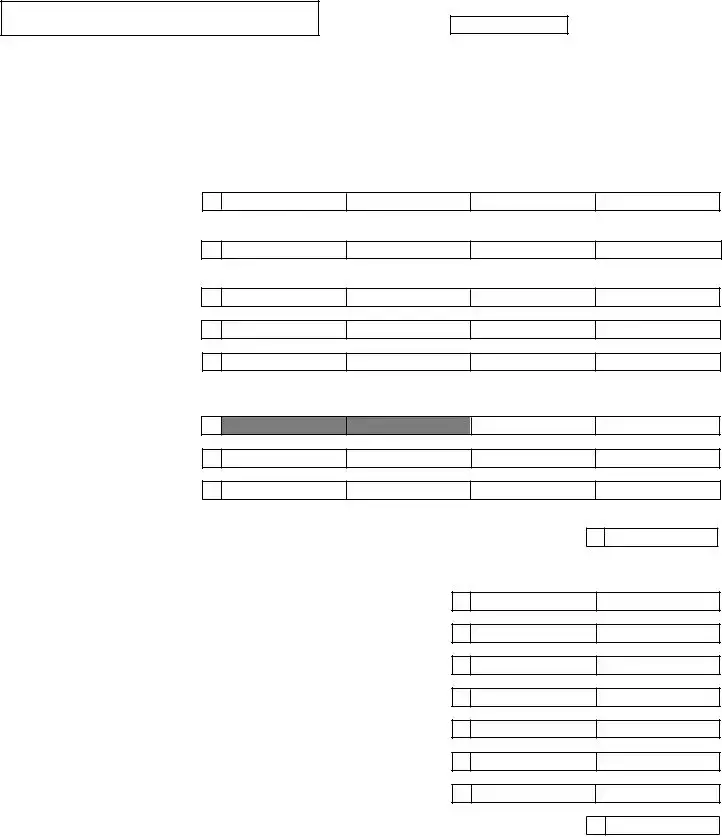

COMPUTATION OF NEW MEXICO PERCENTAGE |

*198180200* |

2019 |

|

Name of estate or trust as shown on Form

FEIN of estate or trust

ESTATES OR TRUSTS WITH INCOME FROM BOTH INSIDE AND OUTSIDE NEW MEXICO MUST COMPLETE THIS SCHEDULE.

NOTE: The separate accounting method may not be used by a business in New Mexico.

1.Dividends..........................................

2.Interest, including

3.Income from other fiduciaries,

S corporations, partnerships, and limited liability entities ......................

4.Rents and royalties...........................

5.Profit or loss from the sale or exchange of ASSETS...........................

6.Net business and farm income. Complete Form

2. See instructions. ...........................

7.Other income. Attach schedule ........

8.Total of lines 1 through 7.................

Column |

1 |

Column 2 |

Column 3 |

Column 4 |

Less related expenses/ |

||||

Gross |

|

distributions |

Net |

Allocation to New Mexico |

|

|

|

|

|

1

2

3

4

5

6

7

8

8a. Calculate allocation percentage for deductions. |

8a |

Divide line 8, column 4 by line 8, column 3 |

_ _ _ . _ _ _ _%

For lines 9, 10, and 11, multiply the amount in Column 3 by the percentage in line 8a to get the allocation to New Mexico in Column 4.

9. Deduction for exemption ................................................................................................

10. Deduction for distributions not shown above...................................................................

11. Other deductions. Attach schedule..................................................................................

12. Total of lines 9, 10, and 11...............................................................................................

13. Taxable income of estate or trust. Subtract line 12 from line 8........................................

14. Income from

15. Total income. Add lines 13 and 14..................................................................................

9

+10

+11

=12

13

+14

=15

16. New Mexico percentage of income. Divide line 15, column 4 by line 15, column 3. |

|

Calculate to four decimal places; for example, 22.6246%. Enter here and on |

16 |

_ _ _ . _ _ _ _%

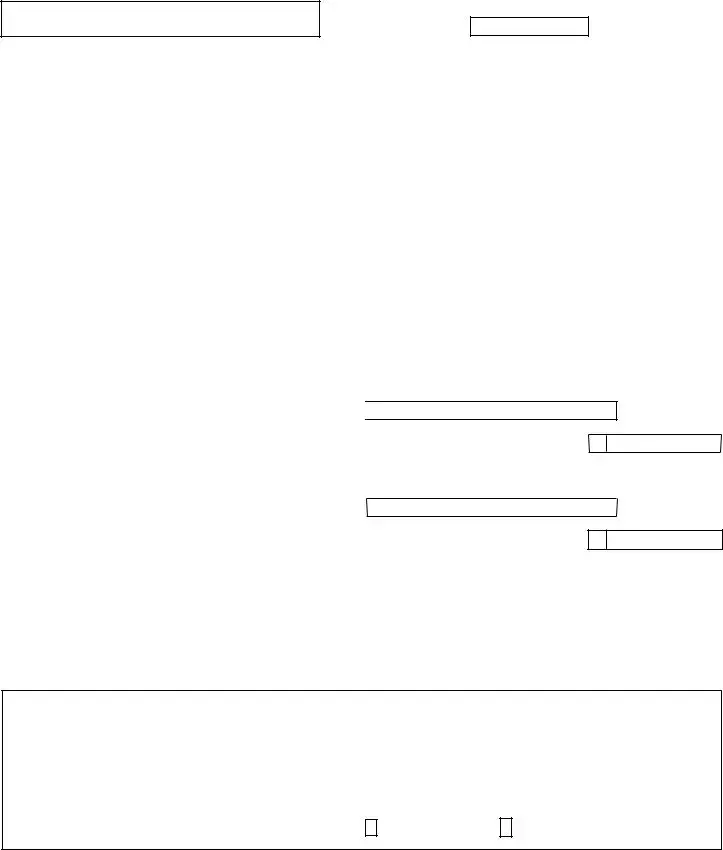

BUSINESS INCOME APPORTIONMENT FORMULA |

*198190200* |

2019 |

|

Name of estate or trust as shown on Form

FEIN of estate or trust

ESTATES OR TRUSTS WITH INCOME FROM BOTH INSIDE AND OUTSIDE NEW MEXICO MUST COMPLETE THIS SCHEDULE.

SEE INSTRUCTIONS BEFORE COMPLETING THIS SCHEDULE.

Calculate each percentage below to

four decimal places; for example, 22.6246%.

|

|

Column 1 |

Column 2 |

|

Percent |

|

PROPERTY FACTOR |

|

Everywhere |

Inside New Mexico |

|

Inside New Mexico |

|

Average annual value of inventory |

1a |

|

|

|

|

|

Average annual value of real property |

1b |

|

|

|

|

|

Average annual value of personal property |

1c |

|

|

|

|

|

............................Rented property. Multiply annual rental value by 8 |

1d |

|

|

|

|

|

Total property |

1e |

|

|

|

|

|

|

|

|

|

|

|

|

...................................................1. Property factor. Divide Total property, Column 2 by Column 1 and then multiply by 100 |

|

1 |

_ _ _ . _ _ _ _% |

|||

PAYROLL FACTOR

Wages, salaries, commissions, and other compensation |

2a |

|

|

|

|

||

of employees related to apportionable income |

|

|

|

.........................................................................2. Payroll factor. Divide Column 2 by Column 1 and then multiply by 100 |

+ |

||

SALES FACTOR |

|

|

|

Gross receipts |

3a |

|

|

3. Sales factor. Divide Column 2 by Column 1 and then multiply by 100 |

............................................................................ |

+ |

|

2_ _ _ . _ _ _ _%

3_ _ _ . _ _ _ _%

4. TOTAL of lines 1, 2, and 3 |

............................................................................................................................................ |

|

|

= |

4 |

_ _ _ . _ _ _ _% |

Count of factors |

4a |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Average New Mexico Percentage. Divide line 4 by the number of factors entered in line 4a |

|

|

|

|||

......................... |

5 |

_ _ _ . _ _ _ _% |

||||

Have you changed your reporting of any class or type of allocated or apportioned income from the way it was reported in

a prior taxable year? |

|

YES |

|

No |

This entity submitted written notification of its election to use one of the special methods of apportionment of business

income for tax year ending _______________. The effective date of the election is |

________________. See instructions. |

Month/Day/Year |

Month/Day/Year |

Mark the box indicating the special method elected.

Manufacturers

Headquarters Operation

Document Properties

| Fact | Detail |

|---|---|

| Form Title | New Mexico Fiduciary Income Tax Return |

| Form Number | FID-1 |

| Submission Address | New Mexico Taxation and Revenue Department, P.O. Box 25127, Santa Fe, NM 87504-5127 |

| Deadline for Calendar Year Estates and Trusts | On or before April 15, 2020 |

| Deadline for Fiscal Year Estates and Trusts | On or before the 15th day of the fourth month following the close of the fiscal year |

| Governing Law(s) | New Mexico Statutes governing fiduciary income and taxation |

Steps to Filling Out Nm Fid 1

Filling out the Nm FID-1, the New Mexico Fiduciary Income Tax Return, is an important step for properly reporting income for estates and trusts. The process might seem complex at first glance, but breaking it down into organized steps can help ensure accuracy and compliance with state tax obligations. Once complete, knowing what happens next is straightforward: Mail the original filled-out form with any due tax payment to the specified address, ensuring it arrives on or before the due date. If sending a payment, avoid sending cash. Here are the steps needed to fill out the form correctly:

- Enter the Name of estate or trust in the space provided.

- Fill in the Name and title of the fiduciary.

- Provide the Address of fiduciary, including city, state, and ZIP code. For foreign addresses, also include the country and foreign province/state.

- Enter the Date the Trust or Estate was created.

- If this is a final fiduciary return, note the liquidation or distribution date.

- Answer whether there has been an IRS adjustment to your federal taxable income not reported to New Mexico.

- Indicate the Federal Employer Identification Number of the estate or trust.

- Select whether the return is for a calendar year or a fiscal year, specifying the beginning and end dates if it's the latter.

- Check the appropriate boxes to indicate if the form is amended, the type of trust, and residency status.

- If applicable, mark if an extension of time to file has been granted.

- Calculate and enter the federal taxable income of the fiduciary, along with any additions or deductions specified on the form and its instructions.

- Fill out the sections related to New Mexico taxable income, tax calculation, and any credits or deductions.

- Enter details for any tax withheld, estimated payments, and distributions.

- Calculate the amount of tax due, penalties, and interest, if applicable, and sum up the total amount due.

- For refunds, provide the banking details for direct deposit, if desired, and specify the allocation of any overpayment.

- Review the form for accuracy, then sign and date it. If someone prepared the form for you, ensure they also sign and include their details.

Your next steps after filling out the form are clear: Prepare any required attachments, double-check the information for accuracy, and mail the document to the address provided by the deadline. If you're making a payment, find the appropriate method to do so, following the form's instructions to avoid sending cash. Completing these steps diligently ensures compliance and helps avoid any potential issues with the New Mexico Taxation and Revenue Department.

Frequently Asked Questions

What is the NM FID-1 form used for?

The NM FID-1 form is a fiduciary income tax return required by the New Mexico Taxation and Revenue Department. It's used by fiduciaries of estates or trusts to report income, deductions, and credits for the entity, calculate New Mexico taxable income, and determine the income tax liability for the entity.

Who needs to file the NM FID-1 form?

Fiduciaries of estates and trusts that earn income within New Mexico or are required to file a federal fiduciary income tax return (Form 1041) with the Internal Revenue Service need to file the NM FID-1 form. However, the fiduciary of a grantor trust, as specified under federal regulation 1.671-4(a), is not required to file this form if filing federally.

When is the NM FID-1 form due?

For calendar year estates and trusts, the due date is on or before April 15th following the end of the tax year. For fiscal year estates and trusts, the form must be filed by the 15th day of the fourth month following the close of the fiscal year. Extensions for filing align with federal or state-approved extensions.

How can a fiduciary calculate New Mexico taxable income on the NM FID-1 form?

New Mexico taxable income is calculated by adding additions to federal income to the federal taxable income of the fiduciary, then subtracting the deductions from federal income. This amount is entered on line 4 of the FID-1 form.

What are the rates or methods for calculating New Mexico income tax due?

The income tax due is calculated by applying the rates provided in the Tax Rate Table found in the FID-1 instructions. The tax calculated is then adjusted based on the New Mexico percentage of income to determine the total New Mexico income tax liability.

Can a credit for taxes paid to another state be claimed on the NM FID-1 form, and how?

Yes, a credit for taxes paid to another state can be claimed on the NM FID-1 form. To calculate and claim this credit, complete the worksheet provided in the instructions, include a copy of the other state's return, and enter the credit amount on line 10.

What documents are required to be attached with the NM FID-1 form?

Required attachments include, but are not limited to, Form RPD-41272 for special underpayment calculations, annual statements for New Mexico income tax withheld not included in specific lines, Forms 1099-MISC or RPD-41285/RPD-41359 for withheld taxes on oil, gas, or income from a pass-through entity, and Schedule FID-D if distributions are made to beneficiaries.

What should be done if there’s an adjustment to federal taxable income after the NM FID-1 has already been filed?

If the Internal Revenue Service adjusts the federal taxable income after the NM FID-1 has been filed and this adjustment has not been reported to New Mexico, an amended New Mexico return must be submitted to report the changes.

Is direct deposit available for refunds from the NM FID-1 form, and are there any restrictions?

Yes, direct deposit is available for refunds. To use this option, the fiduciary must provide the routing number, account number, and specify the account type (checking or savings). However, refunds cannot be directly deposited into accounts located outside of the United States.

Common mistakes

Failing to accurately report federal taxable income adjustments: Individuals often miss including adjustments made by the IRS to their federal taxable income on the New Mexico Fiduciary Income Tax Return. It's critical to submit an amended return if there has been a federal adjustment that has not yet been reported to New Mexico.

Incorrect calculation of New Mexico taxable income: A common mistake is incorrectly adding lines 1 and 2 and then failing to properly subtract line 3, leading to an inaccurate New Mexico taxable income on line 4. Ensuring that these additions and subtractions are done accurately is key to determining the correct tax obligation.

Overlooking deductions and additions specific to New Mexico: Taxpayers often neglect to account for state-specific deductions and additions on lines 2 and 3, which can lead to discrepancies in taxable income. It is important to thoroughly review and include all relevant state-specific financial adjustments.

Misunderstanding the tax rate and incorrectly calculating the tax: The tax on the taxable income amount must be calculated using the Tax Rate Table provided in the FID-1 instructions. Not using or misinterpreting this table can result in an incorrect tax calculation on line 5.

Improper completion or omission of essential information: Many fail to provide complete information, such as the Federal Employer Identification Number or accurately checking the applicable boxes in section G which indicates the type of fiduciary entity. Additionally, not marking the extension of time to file box when applicable can result in penalties.

Recognizing and avoiding these mistakes can ensure the form is filled out correctly and submitted on time, potentially saving time and reducing the likelihood of penalties.

Documents used along the form

Filing taxes for an estate or trust involves more than just filling out the NM FID-1 form. Estates and trusts must navigate through a labyrinth of documents to comply fully with New Mexico's tax laws. Understanding these documents is essential for fiduciaries managing estate or trust taxes.

- RPD-41272: Underpayment of Estimated Tax by Estates and Trusts - This form is for estates and trusts that need to calculate penalties for underpaying estimated taxes. It's specifically designed for those who qualify for special calculation methods and must be attached to the NM FID-1 if applicable.

- RPD-41375: New Mexico Net Operating Loss Schedule - This document is used to report any New Mexico net operating loss that an estate or trust might have incurred. It's relevant for deducting losses from federal income and is essential for managing carryover losses that can affect tax liabilities.

- Form RPD-41285: Oil and Gas Proceeds Withholding Tax Return - Required for estates and trusts receiving income from oil and gas proceeds. The form details the New Mexico income tax withheld from such proceeds before they're distributed to beneficiaries.

- Form RPD-41359: Withholding Tax Return for Pass-through Entity Distributions - This form is necessary when an estate or trust receives income as a beneficiary of a pass-through entity, such as a partnership or S corporation. It reports the New Mexico income tax withheld from these distributions.

- Schedule FID-D: Distributions of Income to Beneficiaries - Part of the NM FID-1 packet, this schedule is used to report the total distributions made to beneficiaries from the estate or trust. Estates and trusts complete this schedule to show how income and tax withholdings have been allocated among beneficiaries.

Together, these forms ensure the accurate reporting and taxation of income in the hands of estates, trusts, and their beneficiaries. Fiduciaries are responsible for understanding each document's role in the broader tax filing process to ensure compliance with both state and federal tax requirements. Ensuring all relevant forms and schedules are accurately completed and submitted with the NM FID-1 form is critical in fulfilling fiduciary duties and avoiding penalties.

Similar forms

The NM FID 1 form is similar to the IRS Form 1041, U.S. Income Tax Return for Estates and Trusts. Both forms are used to report income, deductions, and tax liability for entities considered fiduciaries under tax laws, such as estates and trusts. They require the fiduciary to detail the entity's income, whether it's from interest, dividends, or other sources, and subtract allowable deductions to determine taxable income. Tax computations on both forms consider distributions to beneficiaries and special tax rates applicable to certain types of income. The main difference lies in their jurisdiction; Form 1041 is for federal tax obligations, while the NM FID 1 is used to fulfill state tax requirements in New Mexico.

Another document similar to the NM FID 1 form is the Schedule K-1 (Form 1041), Beneficiary's Share of Income, Deductions, Credits, etc. The Schedule K-1 is a form that accompanies Form 1041 and provides a breakdown of each beneficiary's share of the estate's or trust's income and deductions. Like the NM FID 1, which reports this information at the state level, Schedule K-1 ensures that beneficiaries report their share of the income and deductions on their personal tax returns. It outlines the beneficiary’s share of income, deductions, and credits, allowing them to comply with tax rules. Where the NM FID 1 summarizes fiduciary activity for state tax purposes, Schedule K-1 offers detail for individual beneficiaries for their federal tax filings.

Lastly, the NM FID 1 form shares similarities with Form RPD-41272, Declaration of Estimated Income Tax for Estates and Trusts in New Mexico. Form RPD-41272 is used by fiduciaries to estimate and pay state income tax on behalf of the estate or trust on a quarterly basis. Both the NM FID 1 and Form RPD-41272 ensure compliance with New Mexico's tax regulations for fiduciary entities by calculating tax based on generated income. While the NM FID 1 is filed annually to report taxable income and tax owed or refunded, Form RPD-41272 addresses the need for estates and trusts to make advance tax payments throughout the year, based on estimated income.

Dos and Don'ts

When filling out the NM FID 1 form, certain practices should be followed to ensure accuracy and compliance. Below are eight dos and don'ts to consider:

- Do make sure to use the correct form for the tax year you are filing for. Each year can have important updates or changes.

- Do fill in the Federal Employer Identification Number (FEIN) of the estate or trust accurately; it's required information.

- Do double-check the mailing address and ensure it matches the address on record to avoid any issues with receiving correspondence or refunds.

- Do report any adjustments to your federal taxable income for any prior year as flagged by the Internal Revenue Service.

- Don't send cash. Use other payment methods such as checks or money orders for any tax due.

- Don't overlook the selection of the correct trust type box, such as simple trust, complex trust, or grantor trust, as it can affect tax calculations.

- Don't forget to declare if this is a final fiduciary return by entering the liquidation or distribution date.

- Don't miss the deadlines. For calendar year estates and trusts, the due date is April 15. For fiscal year filers, it is the 15th day of the fourth month after the fiscal year ends.

Following these guidelines will help ensure your NM FID 1 form is filled out correctly and submitted on time, helping to avoid any potential errors or penalties.

Misconceptions

Misunderstandings can often arise when it comes to completing tax-related forms, and the NM FID-1, which is the New Mexico Fiduciary Income Tax Return, is no exception. Here are eight common misconceptions about the form and clarifications to help guide trustees and fiduciaries through the process.

- Fiduciaries can pay any owed tax after the return deadline. It’s crucial to understand that tax due must be paid in full by the filing deadline. Failure to do so could result in penalties and interest charges.

- Estates and trusts have the same filing deadline as individual tax returns. While individual returns typically are due on April 15, fiduciary returns for fiscal year entities are due on the 15th day of the fourth month following the close of their fiscal year, which may not necessarily be April 15.

- All trusts and estates must file the NM FID-1 form. Not every trust or estate is required to file a FID-1. For example, grantor trusts under certain conditions are not required to file this form if filing a federal Form 1041 as dictated by federal regulations.

- The form is overly complex and requires professional help to complete. While seeking professional guidance is beneficial, especially for complicated estates or trusts, the instructions provided with the NM FID-1 are designed to help fiduciaries accurately prepare their tax returns. Careful reading and preparation can enable many to complete the form without professional help.

- Fiduciary returns do not allow for direct deposit refunds. Trustees or fiduciaries can indeed opt for their refunds to be directly deposited into their bank accounts, ensuring they receive their funds more quickly than through traditional mail.

- Amended returns are only necessary if the change increases tax due. If there are adjustments to your federal taxable income by the IRS, whether it increases or decreases your tax liability, an amended New Mexico return must be submitted to report these changes.

- Filing an extension grants extra time to pay due taxes. Filing an extension only extends the time to file the return, not the time to pay owed taxes. To avoid penalties, you must estimate and pay any owed tax by the original due date.

- Fiduciary returns are only concerned with income generated within New Mexico. The NM FID-1 form accounts for income from both inside and outside New Mexico, requiring an apportionment formula to determine New Mexico taxable income correctly.

Understanding these misconceptions can help fiduciaries accurately fulfill their filing obligations and avoid potential issues with the New Mexico Taxation and Revenue Department. When in doubt, consulting the instructions or a tax professional can provide further clarity and guidance.

Key takeaways

Filling out and using the NM FID-1 form, which is the Fiduciary Income Tax Return for New Mexico, involves a series of steps and requirements that estates and trusts must carefully navigate. Here are key takeaways to consider:

- The form must be mailed to the New Mexico Taxation and Revenue Department by April 15, 2020, for calendar year estates and trusts. For fiscal year estates and trusts, the deadline is on or before the 15th day of the fourth month following the close of the fiscal year.

- It's crucial to not send cash when mailing your tax due; ensure that your payment method is compliant with the instructions provided.

- For accurate and timely processing, include the Federal Employer Identification Number (FEIN) of the estate or trust, which is a required field.

- If you're filing an amended return, or if this is a final return indicating liquidation or distribution, specific boxes must be checked, and additional information may be required.

- The form enables fiduciaries to calculate New Mexico taxable income by adjusting federal taxable income with state-specific additions and deductions, ensuring that state tax liabilities are accurately reflected.

- For trusts or estates that have income from both inside and outside New Mexico, completing the Schedule for Business Income Apportionment is necessary to determine the correct amount of income subject to New Mexico tax.

- The option to have the refund directly deposited is available, but it's important to ensure accuracy in providing the routing and account numbers, as well as specifying the account type.

- If the refund is going to or through an account located outside the United States, the direct deposit option cannot be used. This emphasizes the need for careful attention to the refund instructions provided in the form.

By keeping these points in mind and closely following the form instructions, fiduciaries can successfully navigate the complex process of filing the NM FID-1 form, ensuring compliance with New Mexico's tax laws and requirements.

Common PDF Templates

Rpd-41367 - Its structured format aids in the systematic reporting of financial information relevant to New Mexico tax obligations.

Irs W9 Form 2023 - Entity type selection is critical on this form, affecting how the business is taxed and reported to the IRS by the State of New Mexico.