Fill Out a Valid Nm W 9 Template

When engaging in any financial transactions with the State of New Mexico, the Substitute Form W-9 becomes an indispensable document. It serves as a direct request for taxpayer information, crucial for the accurate processing of payments and ensuring compliance with IRS regulations. The form meticulously gathers data ranging from the supplier's legal name, business entity status, to tax identification numbers, catering to a diverse group of individuals and institutions including sole proprietors, government entities, partnerships, and non-profit organizations. Clarity and precision are emphasized with instructions to provide information as it appears on income tax returns, reinforcing the significance of accuracy in financial documentation. Additionally, the Substitute Form W-9 facilitates the selection of appropriate 1099 reporting categories, directly impacting how transactions are documented for tax purposes. It also addresses certification under penalties of perjury that the provided taxpayer identification number is correct and that the individual or entity is not subject to backup withholding. Furthermore, the form makes provisions for opting into direct deposit payments, streamlining the transaction process. This convenience, however, is bound by specific regulations, including a prohibition against processing international ACH transactions, highlighting the form’s role in navigating the complexities of financial transactions while adhering to statutory requirements.

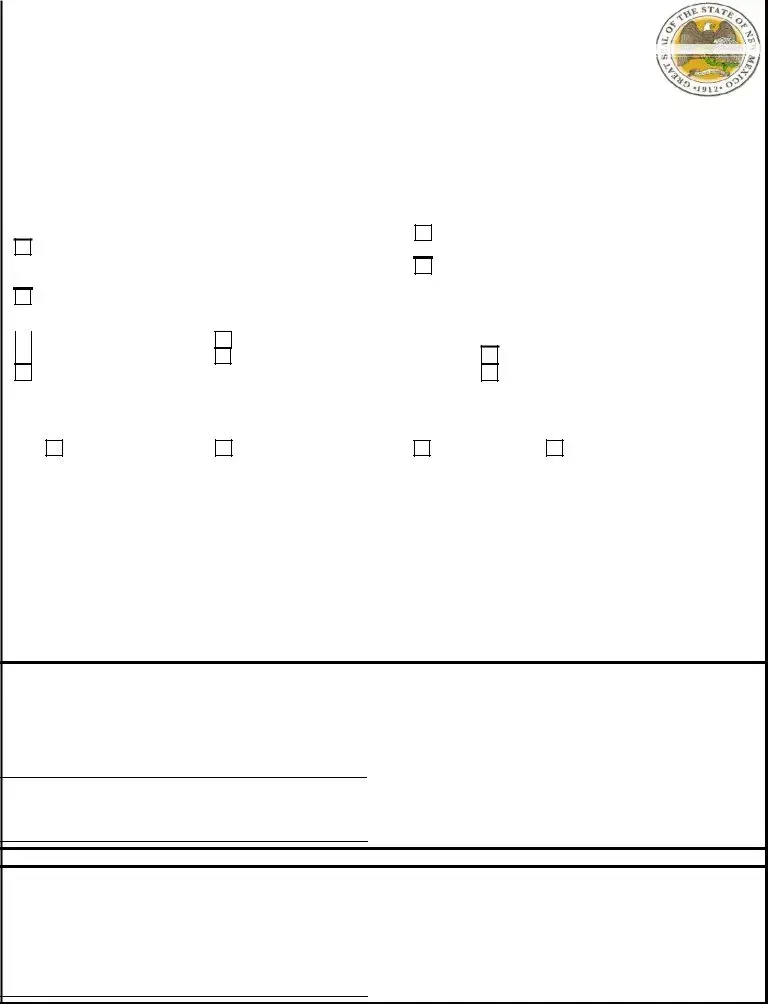

Document Preview

|

DO NOT SEND TO |

|

|

NEW MEXICO DEPARTMENT OF FINANCE & ADMINISTRATION |

|

|

|

|

|

|||||||||||||||||||||||

|

IRS - SUBMIT |

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

FORM TO |

|

|

|

|

|

|

|

FINANCIAL CONTROL DIVISION |

|

|

|

|

|

|||||||||||||||||

|

REQUESTING |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

AGENCY |

|

|

|

|

|

|

|

SUBSTITUTE FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

FCD 04/2021 |

|

REQUEST FOR TAXPAYER INDENTIFICATION NUMBER, CERTIFICATION |

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

TYPE OR PRINT NEATLY, PLEASE REFER TO INSTRUCTIONS FOR MORE INFORMATION |

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

PART I: SUPPLIER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

1. Name: (as shown on your income tax return).Name is required; do not leave blank. |

2 . Business name/disregarded entity name, if different from #1: |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Entity Type (Check only one, unless you are or have been a State of New Mexico Employee, then also check State of New Mexico Employee box): |

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

Individual / Sole Proprietorship / Single Member LLC |

|

|

|

|

|

Government (Local, State, Federal, Tribe) |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

C Corporation / S Corporation |

|

|

|

|

|

|

|

|

|

|

|

State of New Mexico Employee (Agency No.) |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

Trust / Estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=Partnership > _______) |

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. 1099 Reporting: Services provided to the State by vendor: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

Health care or medical service |

|

|

|

|

Royalties |

|

|

|

|

|

|

|

|

|

Agency Volunteer (Agency No.) |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DUAL Supplier & Active NM Employee |

||||||||||||||||||

|

|

|

Attorney services |

|

|

|

|

State of NM Appointed Board member / |

|

|||||||||||||||||||||||

|

|

|

Rental of Real Property |

|

|

|

|

commissioner / committee member |

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART II: TAXPAYER IDENTIFICATION NUMBER (TIN) & TAXPAYER IDENTIFICATION TYPE |

|

|

|

|

|

||||||||||||||||||||||||||

|

1. Enter your TIN here (DO NOT USE DASHES) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

2. Taxpayer Identification Type (check appropriate box): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

Employer ID No. (EIN) |

|

|

|

|

Social Security No. (SSN) |

|

|

|

Employee ID |

|

|

N/A |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART III: ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

1. Address: (Location where payments and correspondances can be sent) |

2. REMITTANCE, IF DIFFERENT: (location specifically used for |

||||||||||||||||||||||||||||||

|

(if a NM state employee, enter Agency name and Field Office Address) |

payment that is different than address 1, if applicable) |

|

|

|

|

|

|||||||||||||||||||||||||

|

Address Line #1 |

|

|

|

|

|

|

|

|

Address Line #1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Line #2 |

|

|

|

|

|

|

|

|

Address Line #2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Line #3 |

|

|

|

|

|

|

|

|

Address Line #3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

City |

|

|

|

|

State |

Zip - 9 Digit |

City |

|

|

|

|

|

State |

Zip - 9 Digit |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART IV: CERTIFICATION

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct tax payer identification number (or I am waiting for a number to be issued to me), AND

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, AND

3. I am a U.S. Citizen or other U.S. person.

The Internal Revenue Service does not require your consent to any provision of this

document other than the certifications required to avoid backup withholding

Printed Name |

|

|

Occupation |

|

Telephone Number |

|

|

|

|

|

|

|

|

Signature |

|

Email for receiving ACH advices |

|

Date (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

PART V: OPTIONAL DIRECT DEPOSIT (ACH)

Warning: The State of New Mexico will not process International ACH Transactions (IAT). If any payment to you from the State will ever result in an IAT under National Automated Clearing House Association (NACHA) operating rules or if you are not sure if the rules apply to you DO NOT FILL OUT THIS SECTION OF THE FORM. Please provide a copy of a voided check or letter from bank confirming information indicated above.

Include a voided check or letter from financial institution if requesting ACH payments |

|

Type of Account |

|

Checking |

|

Savings |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

I acknowledge the IAT warning and authorize the State of New Mexico to initiate direct deposit of funds to the account and |

|

|

|

||||

financial institution indicated, and to recover funds deposited in error if necessary in compliance with NACHA regulations. |

|

|

|

||||

Signature |

Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for Completing this Form

This form substitutes for the IRS

Check the appropriate box(s) that this form is to be utilized and fill in the corresponding section(s) indicated next to the box(s) checked.

PART I: VENDOR INFORMATION

1.Legal Business Name Enter the legal name as registered with the IRS or Social Security Administration.

2.DBA/Trade Name Individuals leave blank. Sole Proprietorships: Enter DBA (doing business as) name. All Others: Complete only if business name is different than Legal Name.

3.Entity Type Check ONE box which describes business entity. If a current, past, or becoming a state employee, please also mark the State of New Mexico Employee box and enter the Business Unit number for the agency. Also, provide the 6 digit employee ID as assigned in SHARE HCM in the Part II Taxpayer Identification Number (TIN) & Taxpayer Identification Type section and mark the Employee ID box.

4.1099 Reporting Check the appropriate box that applies to the type of services being provided to the State. If the type of service is not specifically stated, enter the type of service in the Other box.

PART II: TAXPAYER IDENTIFICATION NUMBER (TIN) & TAXPAYER IDENTIFICATION TYPE

1.Taxpayer Identification Number Enter TIN with no dashes in the boxes provided

a.TIN is always a

b.Employee ID is always a

2.TIN Identification Type Mark the appropriate box for the TIN provided above.

PART III: ADDRESS

1.Address Where correspondence, payment(s), purchase order(s) or 1099s should be sent.

a.Employees If a current employee, please provide this following:

i. |

Address Line #1: |

State Agency Name |

ii. |

Address Line #2: |

Field Office Mailing Address |

iii. |

Address Line #3: |

N/A |

b.CDBG When providing a Community Development Block Grant (CDBG) remittance address, enter CDBG on line #1 and entities remittance address in address line #2

2.Remittance Address If different than Address

3.Zip Code and Phone Number The 5 + 4 code will be required to be entered for all zip codes. If the last 4 digits are unknown, then 4 zeros (0) can be entered. Do not enter the

PART IV: CERTIFICATION

By signing this document you are certifying that all information provided is accurate and complete. The person signing this document should be the partner in the partnership, an officer of the corporation, the individual or sole proprietor noted under legal name above, or the New Mexico State Employee for which the vendor account is established.

Identifying information is required of the person signing the form.

PART V: OPTIONAL DIRECT DEPOSIT (ACH) You may elect to receive payments from the State of New Mexico through Automated Clearing House (ACH) direct deposit. Please provide a copy of a voided check or letter from financial institution with the banking information. Without one of the two items, ACH information WILL NOT be entered and payments will be made by warrant. Select the type of account being provided.

I Acknowledge Print name and sign to acknowledge the IAT warning and to authorize the State of New Mexico to initiate direct deposit of funds to your financial institution provided.

Privacy Act Notice Section 6109 requires you to furnish your correct TIN to persons who must file information

Document Properties

| Fact | Description |

|---|---|

| 1. Substitute for IRS Form W-9 | This form is a state-specific version of the federal IRS W-9 form designed for use by individuals and entities receiving payment from the State of New Mexico. |

| 2. Purpose | The primary function is to request taxpayer identification number (TIN), certification, and to confirm the recipient's legal name and TIN for 1099 reporting requirements by the State of New Mexico. |

| 3. Submission | It should not be sent to the New Mexico Department of Finance & Administration or the IRS. Instead, it goes directly to the Financial Control Division of the agency requesting it. |

| 4. Parts of the form | The form comprises sections for supplier information, TIN & Identification Type, Address, Certification, and optional Direct Deposit (ACH) information. |

| 5. Entity Types | Includes options for individual/sole proprietorship/single-member LLC, various types of corporations, government entities, partnerships, tax-exempt organizations, trusts/estates, and specific designations for State of New Mexico employees. |

| 6. Certification Requirements | By signing the form, the signer certifies the accuracy of the provided information, acknowledges they are not subject to backup withholding, and confirms U.S. citizenship or resident status. |

| 7. Direct Deposit (ACH) | As an optional section, recipients can elect to receive payments via Automated Clearing House by providing bank account information, accompanied by a voided check or a bank letter. |

Steps to Filling Out Nm W 9

Getting through paperwork can be a bit of a hassle, especially when it involves financial or legal details. If you're in the process of working with the State of New Mexico, you might find yourself needing to fill out a Substitute Form W-9. This form is crucial for ensuring that your payments are processed efficiently and that your tax details align with IRS requirements. So, let's walk through the steps needed to fill it out properly, making sure everything is in order for smooth financial interactions with the state.

- Begin by entering your name exactly as it appears on your income tax return in the space provided under Part I: Supplier Information.

- If your business operates under a different name, provide that Business name/Disregarded entity name in the next space.

- Select your Entity Type by checking the appropriate box. If you are, or have ever been, a State of New Mexico Employee, remember to also check that box.

- Under 1099 Reporting, check the box that corresponds with the services you are providing to the State. If your service type isn't listed, specify it in the "Other" box.

- Move to Part II for your Taxpayer Identification Number (TIN) & Taxpayer Identification Type. Enter your TIN without dashes.

- Check the correct box to indicate your Taxpayer Identification Type: Employer ID No. (EIN), Social Security No. (SSN), or Employee ID if you are a state employee.

- In Part III, provide your Address in the designated spaces. This is where payments and correspondence will be sent.

- If your Remittance Address is different from your correspondence address, enter it accordingly.

- In Part IV, by signing, you certify that the information you’ve provided is accurate and that you’re complying with the related IRS guidelines. Enter your Printed Name, Occupation, Telephone Number, and the Date that you’re filling out the form.

- If you prefer to receive payments via direct deposit, proceed to Part V: Optional Direct Deposit (ACH). Indicate your Type of Account and attach a voided check or a bank letter. Remember to acknowledge the IAT warning and sign again in this section.

Once you’ve carefully filled out each part of the form, review your details for accuracy. This form is a key document in ensuring that your financial transactions with the State are handled smoothly and that you’re in compliance with tax reporting requirements. If you have any doubts or need clarification, it’s always a good idea to consult with a financial advisor or the requesting agency. Taking the time to fill out this form correctly will help streamline your interactions and avoid potential headaches down the line.

Frequently Asked Questions

What is the Nm W 9 form used for?

The Nm W 9 form is a substitute for the IRS W-9 form specifically designed for use within the State of New Mexico. It's utilized by individuals or entities that receive payments from the State of New Mexico or are vendors providing goods and services to the state. The primary purpose of the form is to comply with Internal Revenue Service (IRS) regulations regarding 1099 reporting. This involves collecting essential information to verify the official name, the Tax Identification Number (TIN), and the business type of the vendor or individual with the records the IRS has.

Who needs to complete the Nm W 9 form?

Any individual or entity that will receive payment from the State of New Mexico or is a vendor supplying goods or services to the state needs to complete the Nm W 9 form. This includes not only direct contractors and suppliers but also may extend to attorneys, consultants, and agents who under law need to report income and verify their tax identification details with the state.

How do you fill out the taxpayer identification number (TIN)?

To fill out the Taxpayer Identification Number (TIN) on the Nm W 9 form, enter your 9-digit Social Security Number (SSN) or your Federal Employer Identification Number (FEIN) without dashes. If you are a State of New Mexico employee, you should instead provide your 6-digit employee ID assigned during payroll processing in SHARE HCM in the designated space.

Can State of New Mexico employees also use this form?

Yes, State of New Mexico employees can also use this form. For those currently employed by the state or have been in the past, there's an option to mark the "State of New Mexico Employee" box. Employees must include the Business Unit number for their agency and are instructed to provide their 6-digit employee ID in the section for Taxpayer Identification Number (TIN) and Taxpayer Identification Type.

What should be included in the certification part of the form?

In the certification part, by signing you are declaring under penalty of perjury that the TIN you provided is correct (or that you are waiting for a number to be issued), that you are not subject to backup withholding by the IRS, and that you are a U.S. citizen or other U.S. person. The person signing the form should be authorized to do so, such as a partner in a partnership, an officer of a corporation, or the individual or sole proprietor listed under the legal name provided.

Is it mandatory to select direct deposit for payments?

No, selecting direct deposit for payments is optional on the Nm W 9 form. If you prefer to receive payments via Automated Clearing House (ACH) direct deposit, you must provide banking information and a copy of a voided check or a bank letter. If this section is not completed or banking information is not provided, payments will be made by a physical warrant instead.

What address should be used for correspondence and payments?

For correspondence and payments, you should provide the address where you wish to receive mail and payment(s). This can be your primary business address or another designated location. If the remittance address, which is used specifically for payment, differs from the correspondence address, you need to provide that as well. State of New Mexico employees are instructed to use their agency name and field office address for correspondence.

Are international ACH transactions (IAT) allowed?

No, the State of New Mexico does not process International ACH Transactions (IAT). If any payments to you from the State could result in an IAT under National Automated Clearing House Association (NACHA) operating rules, or if you are unsure whether these rules apply to you, you are advised not to fill out the direct deposit section of the form. This precaution helps avoid complications with international banking regulations.

What is the Privacy Act Notice?

The Privacy Act Notice, as mentioned on the form, refers to Section 6109 of the IRS code, which requires individuals and entities to furnish their correct Taxpayer Identification Number (TIN) to entities that must file information returns with the IRS. This provision helps ensure that payments made to you are accurately reported to the IRS, thereby complying with federal tax regulations.

Common mistakes

When filling out the New Mexico W-9 Form, attention to detail is critical for ensuring that the information provided is accurate and complete. However, mistakes can occur, which may lead to delays or issues with payment processing. Here are the ten common mistakes to avoid:

- Failing to include a name as shown on the income tax return in the Supplier Information section can lead to discrepancies with IRS records.

- Overlooking the importance of indicating a business name or disregarded entity name if it's different from the individual name, potentially causing confusion about the entity being paid.

- Checking multiple boxes for Entity Type instead of selecting one, which is necessary unless you're a State of New Mexico Employee, can invalidate the form.

- Not specifying the type of 1099 reporting applicable to the services provided, such as health care, royalties, or attorney services, which helps in determining the tax reporting requirements.

- Entering the Taxpayer Identification Number (TIN) with dashes, contrary to the instructions, which require a 9-digit number without dashes.

- Selecting the wrong Taxpayer Identification Type can lead to issues in tax processing and identification.

- Providing an incorrect address where payments and correspondences should be sent, leading to potential mailing and communication issues.

- Not acknowledging the Optional Direct Deposit (ACH) section's IAT warning and providing incomplete or incorrect banking details for ACH payments.

- Omitting or incorrectly entering the Taxpayer Identification Number (TIN), which is a critical piece of information for tax reporting purposes.

- Failure to provide a signature under the certification section, which attests to the accuracy and completeness of the information provided.

Avoiding these mistakes is vital for ensuring that the processing of payments and tax reporting is done efficiently and accurately. Always double-check the form against the instructions provided to ensure compliance and correctness.

Documents used along the form

When dealing with the process of filling out and submitting a NM W-9 Form, there are several other forms and documents you might find yourself handling as well. These forms often complement the NM W-9 Form or are required in different situations related to financial and tax matters. Understanding their purpose can help ensure you're well-prepared for various business or employment-related responsibilities.

- IRS Form W-4: This form is used by employees to indicate their tax withholdings to their employer. It's important for determining the amount of federal income tax to be withheld from each paycheck.

- IRS Form 1099-MISC: Used to report payments made to independent contractors or freelancers. It's essential for businesses that work with non-employees to provide services or goods.

- IRS Form W-8BEN: This document is required for foreign individuals who are receiving income from U.S. sources. It helps in claiming tax treaty benefits and exemptions from certain withholdings.

- IRS Form W-2: Employers use this form to report wages paid to employees and the taxes withheld from them. It's a crucial document for employees when they file their annual tax returns.

- IRS Form 1040: The standard Internal Revenue Service (IRS) form that individuals use to file their annual income tax returns. It gathers information about income, deductions, and applicable credits.

- IRS Form SS-4: Necessary for obtaining an Employer Identification Number (EIN), this form is typically used by businesses, trusts, estates, partnerships, and other entities.

- Direct Deposit Authorization Form: Although not an IRS form, this document is commonly used alongside the NM W-9 to set up direct deposit for payments, making the transaction process smoother and faster.

Understanding the role and requirements of each of these documents can significantly streamline your financial and tax-related processes. Whether you're an employee, an independent contractor, or a business owner, knowing when and how to use these forms will help ensure compliance with IRS regulations and aid in managing financial transactions more efficiently.

Similar forms

The Nm W-9 form is similar to the federal IRS W-9 form. Both forms are used to provide a Taxpayer Identification Number (TIN) and certification upon request by entities or persons who are required to file information returns with the IRS. They collect information such as the name, address, TIN type (such as Social Security Number or Employer Identification Number), and certification that the TIN is correct, the individual is not subject to backup withholding, and the individual is a U.S. person. The primary difference is that the Nm W-9 form is specifically for use by vendors or entities engaging in transactions with the State of New Mexico, incorporating state-specific requirements.

The form also shares similarities with the IRS Form W-8BEN, "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)," and IRS Form W-8BEN-E, "Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)." While the W-8 forms are used by foreign persons to certify their non-U.S. status, the W-9 and the substitute Nm W-9 are for U.S. persons or entities to provide their tax identification numbers. The W-8 forms, however, specifically cater to non-U.S. individuals or entities, establishing their tax withholding status in relation to U.S. income. Therefore, these forms are complementary in intent — to streamline and clarify tax status and obligations — but serve opposite subsets of the taxpayer population.

Dos and Don'ts

When filling out the NM W-9 form, certain practices should be followed to ensure accuracy and compliance with the Internal Revenue Service (IRS) and State of New Mexico requirements. It is essential to pay close attention to the details to prevent errors that could delay processing. Below are key dos and don'ts to consider:

- Do provide your legal name as it appears on your income tax return to ensure accurate tax reporting.

- Do check the appropriate box for your entity type—this information is crucial for the State of New Mexico to understand how to report your income correctly.

- Do enter your Taxpayer Identification Number (TIN) without dashes. This ensures that your number is correctly recorded and matches IRS records.

- Do accurately indicate the address where you would like to receive payments and correspondence. This helps avoid misdirected payments or information.

- Do not leave the Name field blank. This information is vital for processing the form correctly.

- Do not select more than one entity type unless you are or have been a State of New Mexico employee. Incorrect selection can lead to processing delays.

- Do not ignore the certification section. By signing the form, you certify that all the information provided is accurate and complete under penalties of perjury.

- Do not opt for direct deposit without including a voided check or letter from your bank. Without one of these documents, the State will not process ACH payments.

By following these guidelines, you can ensure a smoother submission process and help the requesting agency process your form more efficiently. Accurate and complete submissions support timely and accurate tax reporting and payment processing.

Misconceptions

Understanding the nuances and common misconceptions surrounding the New Mexico Substitute Form W-9 (Nm W 9 form) is crucial for vendors, state employees, and other entities engaging with state agencies in New Mexico. Let's debunk some of these misconceptions to ensure accurate and efficient handling of your tax information.

Only applicable for tax-related matters: While it's primarily a tax document, the Nm W 9 serves multiple administrative purposes beyond taxes, including identity verification and ensuring compliance with payments and financial transactions within New Mexico state agencies.

Mandatory submission to the IRS: Contrary to what some believe, this form should not be sent to the IRS. Instead, it is collected by the Financial Control Division of the requesting New Mexico state agency to maintain accurate vendor information and comply with IRS regulations internally.

Exclusive to New Mexico businesses: While designed for operations within New Mexico, the form is not exclusively for businesses based in New Mexico. Out-of-state entities conducting business with New Mexico state agencies are also required to complete it.

Only for corporations: This form is not solely for corporations. It is required from individuals, sole proprietors, and other entities, including government bodies, non-profit organizations, and trusts, engaging in business with New Mexico state agencies.

Social Security Numbers are prohibited: In reality, providing a Social Security Number (SSN) is necessary for individuals and sole proprietors who do not have an Employer Identification Number (EIN) when completing the form.

Completion guarantees exemption from backup withholding: Simply filling out the form does not exempt an entity from backup withholding. Certain criteria must be met, including not being currently subject to backup withholding by the IRS, to qualify for exemption.

Does not apply to state employees: State employees, especially those who might receive payments outside of their regular salaries (such as reimbursements or other compensations), may be required to complete the form, contrary to some beliefs.

Electronic submissions are unacceptable: While the form requires comprehensive information, including signatures, electronic submissions may be accepted under certain conditions. It's essential to check with the specific state agency regarding their submission guidelines.

Direct Deposit is automatic upon form submission: Opting into direct deposit requires completing the relevant section of the form and possibly providing additional verification, such as a voided check. Submission of the form alone does not enroll one in direct deposit payments.

Correcting these misconceptions ensures that individuals and entities can efficiently conduct business with New Mexico state agencies, comply with legal requirements, and maintain accurate records for tax purposes.

Key takeaways

- When submitting the Substitute Form W-9 in New Mexico, it is crucial not to send it to the New Mexico Department of Finance & Administration. Instead, it should be directed to the Financial Control Division of the requesting agency, emphasizing the importance of reading and following specific instructions.

- Part I of the form requires comprehensive supplier information, including legal name, business name if different, entity type, and details regarding 1099 reporting. Accuracy here ensures that payments and tax documents align with IRS records, underlining the importance of providing accurate and up-to-date information.

- The taxpayer identification number (TIN) must be entered without dashes in Part II, highlighting the need for detail in presenting one's tax identity accurately. Whether providing a Social Security Number (SSN), Employer Identification Number (EIN), or a specific Employee ID for state employees, proper identification helps to expedite the processing of the form.

- Including the correct address for correspondence and payments in Part III is fundamental for ensuring that all communications and payments reach the intended recipient without delay. This section underscores the relevance of clarity in administrative details to facilitate efficient transactions.

- The certification part (Part IV) of the form requires acknowledgment under penalty of perjury that the information provided is correct. This act binds the signer legally, emphasizing the form's serious and formal nature in affirming tax and identification details.

- Optional Direct Deposit information in Part V offers the convenience of receiving payments through ACH, necessitating a voided check or bank letter to confirm account details. This option, while optional, underscores the move towards electronic transactions for efficiency and security.

Common PDF Templates

New Mexico Oversize Permits - Outlines the necessity for specifying the towing unit's details, including year, make, and VIN, to assess transportation capability.

Land Contract Template - Conditions under which the purchase agreement can be amended due to appraisal outcomes are discussed, ensuring flexibility in valuation discrepancies.