Fill Out a Valid State Of New Mexico Wc 1 Template

The State of New Mexico WC-1 form serves as a crucial tool in the administration of workers' compensation fees, evidencing the commitment of employers towards maintaining a protective net for their employees against workplace injuries. Since the calendar quarter ending September 30, 2004, the fee required by this form has seen a modest increase from $4 to $4.30 for each covered worker, reflecting a slight uptick in the employer’s financial responsibility. This increment only affects the employer's share, underscoring the state’s aim to bolster worker protection without imposing additional financial burdens on the employees themselves. The document mandates submission by every employer under the umbrella of the Workers' Compensation Act, highlighting the inclusivity and mandatory nature of this provision. Whether compliance is obligatory or a voluntary safety net elected by the employer, the completion and timely submission of the WC-1 form with the accurate number of covered workers for the specified reporting period is imperative. Furthermore, this piece articulates necessary details such as the assessment fee, any applicable penalties, interest, and the collective total due, along with procedural instructions for submission, thereby serving as an all-encompassing guide for employers in New Mexico to adhere to their statutory obligations. The provision for assistance and the requirement of retention of records underscore the state's efforts to streamline the process, offer support, and ensure accountability across all spheres of the workers’ compensation framework.

Document Preview

STATE OF NEW MEXICO

TAXATION AND REVENUE DEPARTMENT

Beginning with calendar quarter ending September 30, 2004, the quarterly workers' compensation fee paid on Form

See the instructions for details.

WHO MUST FILE: Every employer who is covered by the Workers' Compensation Act, whether by requirement or election, must file and pay the New Mexico Workers' Compensation Fee and file Form

*IMPORTANT: On Line 1, enter the number of workers (employees) to whom the Workers' Compensation Fee applies. This is the number of covered employees you employed on the last working day of the calendar quarter. If you have no covered employees, enter zero.

WHEN TO FILE: The Workers' Compensation Fee is due on or before the last day of the month following the close of the report period. A report period is a calendar quarter ending March 31, June 30, September 30 and December 31.

Upon completion of this form, sign, date and enter your phone number and

Mail the bottom portion of this form with payment to New Mexico Taxation and Revenue Department, P.O. Box 2527, Santa

Fe, NM

A.FEIN:

B.CRS:

C.EAN:

NAME:

STREET/BOX:

CITY, STATE, ZIP:

REPORT PERIOD:

Beginning

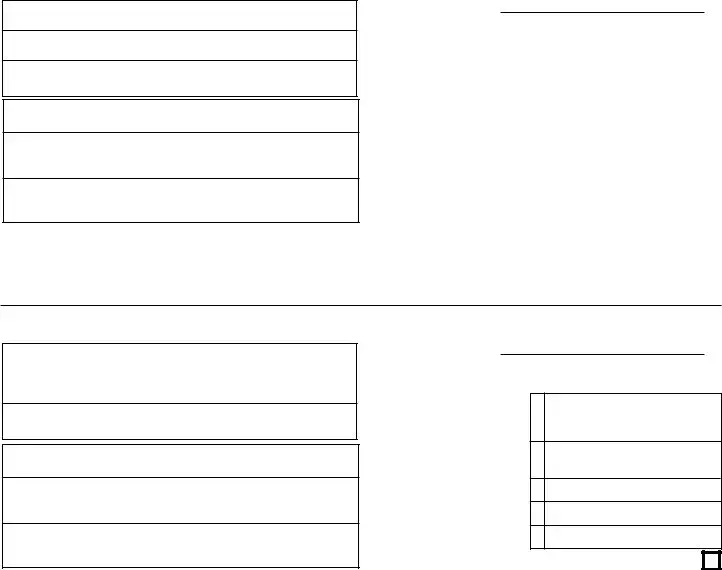

1. *Number of covered |

|

|

|

|

|

||

|

workers at close of |

|

|

|

report period |

1. |

|

2. |

Assessment fee |

2. |

$ |

3. |

Penalty |

3. |

$ |

4. |

Interest |

4. |

$ |

5. |

Total due |

5. |

$ |

PLEASE CUT AND INCLUDE THE BOTTOM PORTION WITH YOUR PAYMENT

RETAIN THE UPPER PORTION FOR YOUR RECORDS

WORKERS' COMPENSATION FEE

A. |

FEIN: |

|

|

B. |

CRS: |

REPORT PERIOD:

Beginning |

Ending |

C. EAN: |

NAME: |

STREET/BOX:

CITY, STATE, ZIP:

1.*Number of covered workers at close of report period

2.Assessment fee

3.Penalty

4.Interest

5.Total due

1.

2.$

3.$

4.$

5.$

Check if amended

Signature ___________________________________ Phone ______________ Date _____________

Mail to: Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM |

WKC |

Document Properties

| Fact | Detail |

|---|---|

| Form Identification | RPD-41054 Rev. 08/2010, known as WC-1 Workers' Compensation Fee Form |

| Department Responsible | State of New Mexico Taxation and Revenue Department |

| Fee Increase Date | Beginning with the calendar quarter ending September 30, 2004, the fee increased from $4 to $4.30 per covered worker. |

| Mandatory Filers | Every employer covered by the Workers' Compensation Act, by requirement or election, must file this form along with the New Mexico Workers' Compensation Fee. |

| Reporting Periods | The Workers' Compensation Fee is due the last day of the month following a quarter ending March 31, June 30, September 30, and December 31. |

| Payment and Submission | Payment via check or money order payable to Taxation and Revenue Department, and mail to: Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM 87504-2527. |

| Governing Law(s) | Workers' Compensation Act of the State of New Mexico |

Steps to Filling Out State Of New Mexico Wc 1

When it comes time to report and contribute to the workers' compensation fund, employers in New Mexico have an important role to play. The Form WC-1 is a crucial document that facilitates this process, ensuring that employees have access to workers' compensation in case of a workplace injury. Filling out this form accurately and on time maintains compliance with state regulations and supports the wider framework of workplace safety and compensation. Follow these detailed steps to accurately complete the WC-1 Form for the State of New Mexico.

- Begin by writing down the Federal Employer Identification Number (FEIN) in section A.FEIN.

- Enter the Combined Reporting System (CRS) number in the B.CRS section.

- In section C.EAN, input the Employer's Account Number.

- Under NAME, provide the legal name of the company or employer.

- For the address, fill out the STREET/BOX section, ensuring it includes the complete mailing address.

- Specify the CITY, STATE, ZIP in the designated space to ensure clarity on the location.

- Identify the report period by entering the start and end dates in REPORT PERIOD: Beginning (mm-dd-yy) and Ending (mm-dd-yy).

- In item 1., accurately report the *Number of covered workers at the close of the report period. If there were no covered employees, remember to enter zero.

- Calculate the Assessment fee based on the number of covered workers and enter this amount in section 2.

- If applicable, include any Penalty amount in section 3.

- Fill out the Interest section 4 if there are any interest charges.

- Add up the Assessment fee, any Penalty, and Interest to find the Total due and write this in section 5.

- If changes are made to a previously filed form, check the box labeled Check if amended.

- Sign the form at the bottom where it says Signature to validate the information provided.

- Next to the signature, fill in the date on which the form was completed.

- Provide a contact Phone number and E-mail address for the employer or the person who filled out the form.

- Finally, detach the bottom portion of the form as indicated by the instruction PLEASE CUT AND INCLUDE THE BOTTOM PORTION WITH YOUR PAYMENT RETAIN THE UPPER PORTION FOR YOUR RECORDS and mail it along with the payment to Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM 87504-2527.

Once completed, retaining a copy of the WC-1 Form for your records is important, as is ensuring the bottom portion and payment reach the New Mexico Taxation and Revenue Department on time. In case of queries or need for assistance, reaching out to the contact number provided on the form can provide employers with the necessary support to fulfill their obligations smoothly.

Frequently Asked Questions

Frequently Asked Questions about the State of New Mexico WC-1 Form

- Who is required to file the WC-1 form?

- When should the WC-1 form be filed and the associated fee paid?

- What is the required fee per covered worker, and did it change recently?

- Where should the WC-1 form and payment be sent?

All employers who are covered by the Workers' Compensation Act, whether mandated by law or by choice, are required to file the New Mexico Workers' Compensation Fee using Form WC-1. This includes employers with any number of employees to whom the Workers' Compensation Act applies. If an employer has no covered employees during the reporting period, they should enter zero on the form.

The Workers' Compensation Fee must be paid and Form WC-1 filed by the last day of the month following the close of a calendar quarter. The report periods end on March 31, June 30, September 30, and December 31. Timely filing is crucial to avoid potential penalties and interest charges for late submission.

Starting from the calendar quarter ending September 30, 2004, the quarterly workers' compensation fee increased from $4 to $4.30 for each covered employee. It's important to note that this increase affects only the employer's contribution towards the Workers' Compensation Fee.

The completed WC-1 form along with the payment should be mailed to the New Mexico Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM, 87504-2527. Employers are advised to retain the top portion of the form for their records and mail the bottom portion with the payment. For those needing assistance or have further questions, they can call (505) 827-0832.

Common mistakes

When filling out the State of New Mexico WC-1 form for Workers' Compensation Fee, individuals sometimes encounter pitfalls that can affect the accuracy and acceptance of their submission. Being mindful of the following mistakes can streamline the process and ensure compliance with state requirements.

- Not verifying the number of covered workers – On Line 1, accurately reporting the number of employees covered at the close of the report period is critical. Underreporting or overreporting can lead to discrepancies and potential issues with the Taxation and Revenue Department.

- Omitting or entering incorrect FEIN, CRS, or EAN – These identifiers are essential for the state to process your form correctly. Double-check these numbers for accuracy to avoid processing delays.

- Incorrect calculation of the assessment fee – Ensure that the calculation of $4.30 per covered worker is accurately done. Simple mathematical errors can result in either underpayment or overpayment.

- Ignoring penalty and interest charges – If applicable, ensure to include any penalty and interest charges in the designated sections. Failing to include these amounts may result in an outstanding balance with the department.

- Forgetting to sign and date the form – The form is not considered complete without a signature and date. An unsigned form can lead to rejection or a request for a new submission.

- Leaving contact information sections blank – Providing a phone number and email address is crucial for any follow-up or clarification needed from the state. Ensure these fields are filled out to avoid processing delays.

- Not making the payment payable to the correct entity – The check or money order should be made payable to the Taxation and Revenue Department. Incorrectly addressed payments can lead to payment processing issues.

- Mailing the form to the wrong address – The bottom portion of the form, along with payment, must be sent to the specified P.O. Box in Santa Fe, NM. Sending it to an incorrect location can cause unnecessary delays.

- Failure to retain the top portion for records – It’s important to keep the upper portion of the form. This acts as proof of submission and is essential for record-keeping purposes.

In conclusion, the careful completion of the WC-1 form is crucial for compliance with the New Mexico Workers' Compensation Fee requirements. By avoiding these common mistakes, employers can ensure their submission is processed efficiently and accurately. Attention to detail and thorough review before submission can prevent unnecessary delays and penalties, helping maintain good standing with the Taxation and Revenue Department.

Documents used along the form

When managing workers' compensation in New Mexico, employers are required to complete and file the WC-1 form, which is crucial for the administration of workers' compensation fees. Alongside the WC-1 form, several additional forms and documents are often necessary to ensure comprehensive compliance and facilitate various workers' compensation processes. The following are some of those key documents and brief descriptions of each to aid in understanding their function and importance.

- Employer's First Report of Injury or Illness (Form E1.2): This form is used by employers to report an employee's work-related injury or illness to the New Mexico Workers' Compensation Administration (WCA). It's a critical first step in the claims process.

- Notice of Accident (NOA) form: Employers must provide this form to employees immediately after being notified of a work-related injury. It contains information on the employee's rights and the steps to take following an injury.

- Wage Verification Form (Form WVF): Used to verify an injured worker's earnings, this form helps in calculating workers' compensation benefits accurately.

- Agreement as to Compensation Paid (Form WC-22): This form is filled out when an agreement is reached regarding the compensation benefits to be paid to an injured worker. It details the terms of the agreement.

- Annual Payroll Report Form: Employers must annually report their total payroll to their workers' compensation insurance carrier. This report influences the cost of workers' compensation insurance premiums.

- Certificate of Compliance with New Mexico Workers' Compensation Act: This certificate serves as proof that an employer complies with the state's workers' compensation laws. It is often required when contracting with other businesses.

- Worker's Authorization for Release of Health Information (HIPAA Release Form): This form allows for the release of a worker's health information to their employer or insurance carrier, facilitating the processing of workers' compensation claims.

- Application for Review by Workers' Compensation Judge (Form WC-A): Should there be disputes regarding workers' compensation claims, this form is used to request a review of the case by a judge in the Workers' Compensation Administration.

Together, with the State of New Mexico WC-1 form, these documents form a comprehensive framework for managing workers' compensation claims efficiently and compliantly. It is essential for employers to be familiar with these forms, understand their purposes, and know how to correctly complete and file them as part of their administrative responsibilities under the New Mexico Workers' Compensation Act.

Similar forms

The State Of New Mexico WC-1 form is similar to the Federal Form 940, which is the Employer's Annual Federal Unemployment (FUTA) Tax Return. Both forms are used by employers to report taxes related to employment, but they serve different purposes within the spectrum of employment-related taxes. The State of New Mexico WC-1 form is specifically designed for reporting and paying the Workers' Compensation Fee, a requirement for employers under the state's Workers' Compensation Act, while the Federal Form 940 is aimed at reporting and paying federal unemployment taxes owed by employers. Despite these differences, both forms require employers to calculate taxes based on employee counts and wages paid, and both have penalties for late filings. Additionally, each form is critical for compliance with their respective regulatory requirements, ensuring that workers are covered either for unemployment or work-related injuries and illnesses.

Another document the State Of New Mexico WC-1 form resembles is the State Unemployment Tax Act (SUTA) filings that every state requires from its employers. Although these documents are specific to each state and can vary in format and instructions, their common purpose is to fund state unemployment insurance programs. Like the WC-1 form, SUTA filings require employers to report the number of employees, total payroll, and calculate the taxes due based on rates determined by the state. Both types of forms are adjusted periodically for changes in taxable wage bases or rates and embody the shared principle of supporting workers, either through compensation for work-related injuries or providing financial assistance during periods of unemployment. The core similarity lies in their function as state-mandated, employer-filled documentation meant to support and protect the workforce.

Dos and Don'ts

Filling out the State of New Mexico WC-1 form is a straightforward process, but attention to detail is crucial. Here’s a concise checklist for employers to ensure accurate completion and submission of this document.

Do:

- Double-check the number of covered workers — Verify the count of employees covered under Workers' Compensation at the close of the report period. Accuracy here impacts the assessment fee calculation.

- Ensure the employer identification number (EIN), the combined reporting system (CRS) identifier, and the Employer Account Number (EAN) are correct. Mistakes can lead to processing delays or misapplied payments.

- Correctly calculate the assessment fee due based on the number of covered employees and the current rate. Remember, changes in rates can affect the amount due.

- File and pay the Workers’ Compensation Fee on time — ideally before the last day of the month following the close of the report period to avoid penalties and interest.

- Retain the upper portion of the form for your records after mailing the bottom portion with payment. This serves as proof of compliance and can be invaluable during audits or disputes.

Don't:

- Avoid guessing the number of covered workers. Late adjustments might lead to unnecessary complications, including the possibility of incurring penalties.

- Do not fill out the form with outdated information. Ensure all business information is current, including any changes in contact details.

- Do not neglect to calculate the total due accurately, incorporating assessment fees, any due penalties, and interest. Incorrect totals can delay the processing of your form.

- Avoid submitting the form without a signature. An unsigned form is considered incomplete and can result in processing delays or the assumption of non-compliance.

- Lastly, do not disregard the importance of checking if the form is amended. If you’re submitting corrections to a previously filed WC-1 form, indicating its amended status is crucial for accurate processing.

By adhering to these guidelines, employers can ensure they remain in compliance with New Mexico's Workers' Compensation requirements, avoiding penalties and maintaining smooth operational flows for their businesses.

Misconceptions

Only large businesses need to file the WC-1 form: This is a common misconception. In reality, every employer covered by the Workers' Compensation Act, regardless of their size, must file the Form WC-1 and pay the New Mexico Workers' Compensation Fee. This includes both large corporations and small business owners who employ a minimal number of workers.

The fee has always been $4.30 per employee: Actually, the fee increased from $4 to $4.30 per covered worker starting with the calendar quarter ending September 30, 2004. Before this date, the fee per employee was lower, demonstrating the government's adjustments to the workers' compensation fees over time.

You only need to file if you have a certain number of employees: This statement is incorrect. The instructions clearly state that on Line 1, you should enter the number of covered workers you employed on the last working day of the calendar quarter, whether that's one, a hundred, or even zero. Every covered employer must file this form, regardless of the number of employees.

There's no deadline for filing the form: Contrary to what some might think, there is a specific deadline. The Workers' Compensation Fee and corresponding Form WC-1 are due on or before the last day of the month following the close of the report period. Missing this deadline may result in penalties, emphasizing the importance of timely compliance.

Key takeaways

Understanding the State Of New Mexico WC-1 form is critical for employers to ensure compliance with the Workers' Compensation Act requirements. Here are four key takeaways that can help employers navigate the process more effectively:

- The rate for the quarterly workers' compensation fee increased to $4.30 per covered employee, starting from the calendar quarter ending September 30, 2004. This increase affects only the employer's share, highlighting the importance of staying updated with the current rates to avoid underpayment.

- All employers covered by the Workers' Compensation Act, whether mandatorily or by election, are required to file the WC-1 form and pay the corresponding workers' compensation fee. This underscores the broad applicability of this requirement across various types of employment arrangements in New Mexico.

- Employers must accurately report the number of covered employees as of the last working day of the calendar quarter. It's essential for employers to maintain accurate employment records, as this number directly influences the workers' compensation fee due.

- The WC-1 form and the associated fee are due on or before the last day of the month following the close of the report period. Timeliness in filing and payment is crucial to avoid penalties, signifying the importance of adhering to the specified deadlines for each reporting period.

Understanding and managing the workers' compensation fee process through the State Of New Mexico WC-1 form is vital for employers to ensure compliance and avoid penalties. Employers must keep abreast of rate changes, maintain accurate employment records, and adhere to filing deadlines to facilitate a smooth process.

Common PDF Templates

New Mexico Courts - Enables plaintiffs to declare the value of the claim being made against the defendant, including any additional demands such as interest and court costs.

Board of Nursing Nm - The directive that misrepresentation could lead to disciplinary action reinforces the legal and ethical obligations of nurses in New Mexico, highlighting the critical nature of accurate self-reporting.